Some morning reads:

• Today’s WTF headline: Jim Cramer: Economy Set for a Long-Term Bull Run (CNBC) but see Tax changes loom, it may be time to harvest gains (Market Watch)

• TAG Actually Gives Big Banks the Advantage (American Banker) see also New MBS twist: Sand Canyon sues servicer for releasing loan info (Reuters)

• The Changing Face of Foreclosures (Fed New York)

• Buffett Seizes Lead in Bet on Stocks Beating Hedge Funds (Bloomberg) see also Buffett Rule Tax Bill Would Raise $47 Billion Over 10 Years (Bloomberg)

• Masters of the Universe Start to Challenge Ben Bernanke (Bloomberg)

• “Muppet” hunt: Goldman conducts company-wide email review: sources (Reuters) see also Goldman Thinks You Should Buy Stocks Because You Don’t Think You Should Buy Stocks (Dealbreaker)

• $1.5 billion: The cost of cutting London-Tokyo latency by 60ms (Extreme Tech)

• How to Save Cyberspace (The Diplomat)

• Stand Up Comics Are Now Selling Laughs by the Download (NYT)

• Angry Words: Foundation of modern linguistics? (Chronicle)

What are you reading?

>

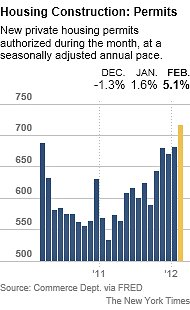

Home Builder Stocks at Highest Point in 2 Years After 6-Month Rise

Source: NYT

What's been said:

Discussions found on the web: