My afternoon train reading:

• Fed’s Stress-Test Champion Reshapes Regulation of Biggest Banks (Bloomberg) see also The Volcker Rule and the Goldman Controversy (DealBook)

• Takeover Defense, Goldman Style (Circa 1960s) (Economix)

• U.S. Auto Dealers Who Survived Debacle See Record Sales (Bloomberg) but see Is Warm Weather Putting a False Shine on the Economy? (BusinessWeek)

• What Isn’t for Sale? (The Atlantic)

• Capital shortfall: A new approach to ranking and regulating systemic risks (Vox) see also Stress Tests for Zombies? Why Low Interest Rate Policy Does Not Work (Institutional Risk Analyst)

• The Man Who Broke Atlantic City (The Atlantic)

• Wikipedia Didn’t Kill Britannica. Windows Did (Wired)

• LinkedIn is the Gateway Drug to Social Media for Fin Services (HuffPo)

• Umair Haque: The Builders’ Manifesto (HBR)

• Alone in a Crowd: How Crowdfunding Could Strand Startups (Businessweek)

What are you reading?

>

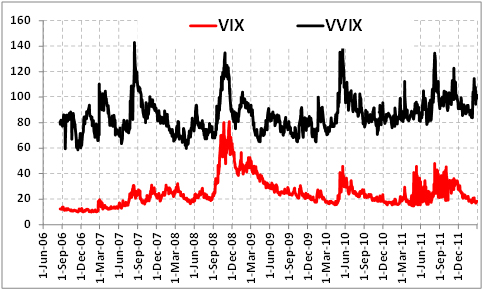

WTF?! DOUBLE THE FUN WITH CBOE’s VVIX

Source: CBOE

What's been said:

Discussions found on the web: