My morning reading material:

• How We Opt Out of Overoptimism: Our Habit of Ignoring What Is Real Is a Double-Edged Sword (Scientific American)

• Bull versus Bear:

…..-Expect Stocks to Be Higher by Year End (Minyanville)

…..-A rally built on fairy tales (MSN Money)

• When Bigger Isn’t Better: Profiling ETF Alternatives To DJP, FXI, GLD (ETFdb)

• Falling for the Lottery Trick (NYT) see also Are the Rich Driving Americans to Spend Too Much? (WSJ)

• Bernanke Returns to Academic Roots to Justify Fed’s Existence (Bloomberg)

• “Why I Left Goldman Sachs” (VERSION TWO) (Jacki Zehner) see also Three’s a Crowd (The Epicurean Dealmaker)

• Mayor Bloomberg’s crony capitalism (Market Watch)

• Crude drops after Saudi intervention (FT.com)

• Bartlett: The Origin of Modern Republican Fiscal Policy (Economix)

• The Paul Clement Court (NY Mag) see also Could Corporations Take Tax Breaks on Political ‘Dark Money’? (ProPublica)

What are you reading?

>

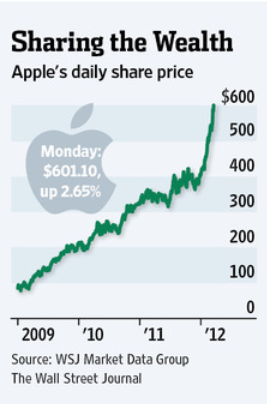

Apple Pads Investor Wallets

Source: WSJ

What's been said:

Discussions found on the web: