Afternoon Train Reading:

• Swiss Secrecy Besieged Makes Banks Fret World Money Lure Fading (Bloomberg)

• No-Growth Capitalism’s post-crash manifesto (Market Watch)

• Six ‘Investment Potholes’ That May Hinder the Stock Rally (WSJ)

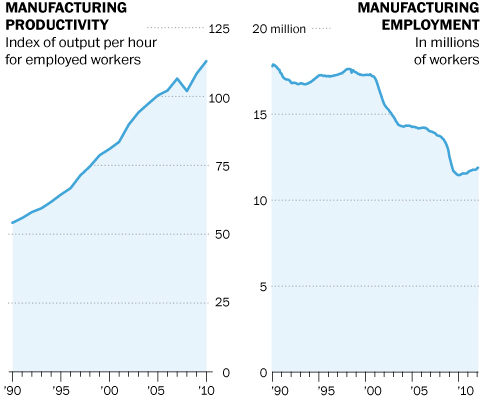

• Economists offer more pessimistic view on manufacturing in upcoming report (Washington Post) see also The fake housing recovery (Money CNN)

• China Quietly Relaxes Controls on Foreign Capital (NYT)

• Tee hee: Michael Dell should be satisfied (DCurtis) see also What is the next industry Apple can disrupt? Banking! (Gigaom)

• Speaking of Fees: Money Talks (Columbia Journalism Review)

• Taxes Are Rising for the Wealthy (WSJ)

• Political intelligence: Wall Street pays handsomely for Washington inside dope (Yahoo Finance)

• CIA divorces: The secrecy when spies split (Washington Post)

What are you reading?

>

U.S. manufacturing by the numbers

Source: Washington Post

What's been said:

Discussions found on the web: