My afternoon train reads:

• Lying By Omission: Mutual Funds, Track Records and Departing Managers (Reformed Broker) see also Fix Your 401(k) (SmartMoney)

• Why More Stimulus Now Would Pay for Itself—Really! (Atlantic)

• Johnson & Kwak: Abandoning Gold Helped Dollar Gain Preeminence (Bloomberg)

• Nocera: Government’s Not Dead Yet (NYT)

• TARP Fail: Bailout Braggadocio Doesn’t Pay in the End (WSJ)

• How Well Do Initial Claims Forecast Employment Growth Over the Business Cycle and Over Time? (Fed St. Louis)

• What Tim Cook is doing in China (Gigaom) see also Apple Plans Further Investment in China as Cook Visits (Bloomberg)

• The originality of the species (Guardian)

• China Banks Said to Underestimate Local Government Risks (Bloomberg) see also China Soft Landing May Be Hard for Commodity Exporters (Bloomberg)

• Just the Facts. Yes, All of Them. (NYT)

What are you reading?

>

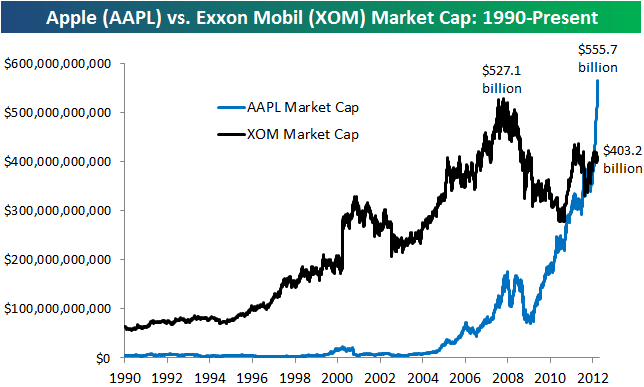

Apple (AAPL) vs. Exxon Mobil (XOM) Market Cap Comparison

Source: Bespoke

http://www.bespokeinvest.com/thinkbig/2012/3/26/apple-aapl-vs-exxon-mobil-xom-market-cap-comparison.html

What's been said:

Discussions found on the web: