>

My Sunday Washington Post Business Section column is out. This morning, we look at a pretty rad option for Apple and its cash hoard: Buying Twitter.

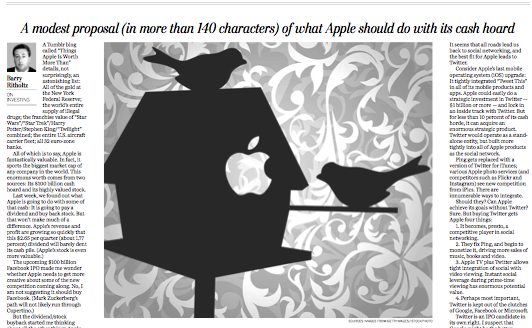

The print version had the full headline A modest proposal (in more than 140 characters) of what Apple should do with its cash hoard. (The online version is merely Why Apple should use its cash hoard to buy Twitter).

As noted earlier this week, Apple has gained zero traction in Social, which has become the hottest trend in technology this decade.

Here’s an excerpt from the column:

“One acquisition stands out to me as a model for what Apple could do: Google’s all-stock acquisition of YouTube for $1.65 billion in 2006.

Essentially, it was free. The market rallied Google’s stock enough on the news that the acquisition had an effective cost of zero (though it was slightly dilutive to earnings). YouTube became one of the fastest-growing parts of Google, replacing the underperforming Google Video. Monetization of YouTube appears to be increasingly close.

And Apple? Its history is primarily of small, almost tactical purchases. Even its biggest buy, the 1997 purchase of Next Computer that returned the prodigal son Steve Jobs to Apple, was “only” $400 million.

But Apple was a very different company then — a small, niche computer maker, with a visionary at the helm. The Apple of today is a giant consumer electronics firm, selling mobile devices, telephones, tablet computers and, in the near future, televisions. Maintaining mindshare, staying on the cutting edge of consumer tastes, is more important to Apple today than it was 15 years ago.”

I really like what the Post did in the dead tree version of the paper, the art work is whimsical.

>

click for ginormous version of print edition

>

Source:

Why Apple should use its cash hoard to buy Twitter

Barry Ritholtz

Washington Post, March 25, 2012

http://www.washingtonpost.com/apples-hoard-and-how-it-should-be-used-think-twitter/2012/03/19/gIQAS7TfVS_story.html

Washington Post, March 25, 2012 page G6 (PDF)

What's been said:

Discussions found on the web: