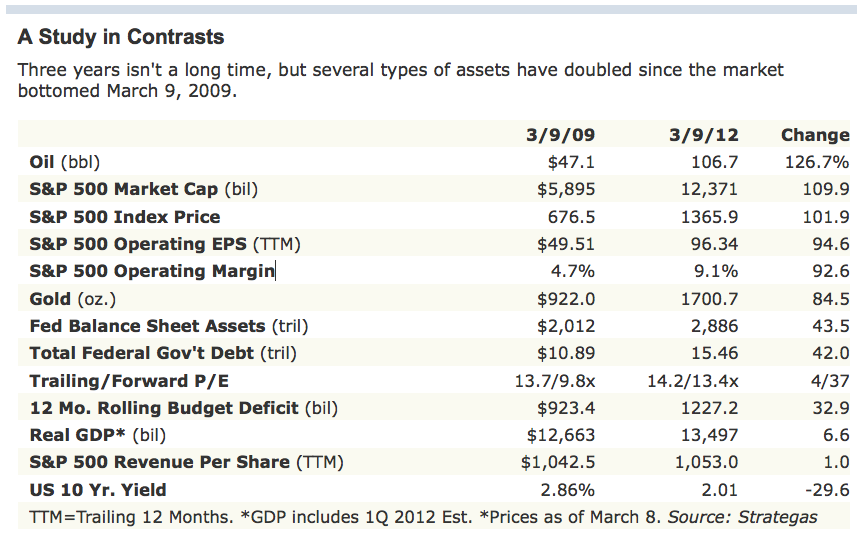

Since the market made its infamous 666 low three years ago yesterday, how have various asset classes performed? Strategas Partners via Barron’s gives us the details:

>

>

I would have included Nasdaq, the Dow, small caps, food stuffs as well, but a nice collection of data.

>

Source:

Stocks End Mixed, as Small-Caps Shine

VITO J. RACANELLI

Barron’s MARCH 10, 2012

http://online.barrons.com/article/SB50001424052748704759704577263441544381030.html

What's been said:

Discussions found on the web: