We posted yesterday that the S&P500 was set up for a pullback after carving out an outside day (higher high and lower low than previous day) at strong resistance and looked for follow through selling today. Didn’t happen.

In fact, the S&P500 followed yesterday’s outside day with an inside day with today’s high/low lower/higher than yesterday’s. This reflects a lack of sellers and nervous buyers.

An inside day following an outside day is a relatively rare three-day pattern and has initially happened on six times since the current bull market began on March 6, 2009. In every case, the post 5-day return on the S&P500 was positive, averaging 2.08 percent.

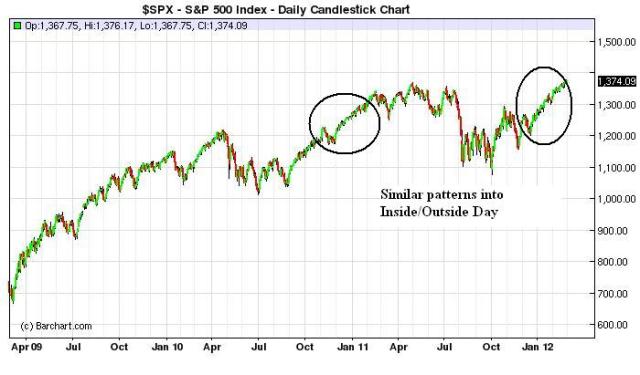

Today’s pattern and run up looks very similar to the one made on January 31, 2011. The S&P500 rallied 22 percent in 108 trading days from the August 26, 2010 low into the inside/outside three-day pattern. It added another 4.4 percent in the next 14 trading days before correcting.

As of today’s close, the S&P500 is up 25 percent in the 1o3 trading days since the October 4th low. The market does feel like it lacks sellers and needs a real catalyst to knock it down, in our opinion. Interestingly, there are 13 trading days to the March 20th Greek bond maturity, which could suffer complications and provide the catalyst for a global equity correction.

Like many — maybe too many – we remain cautious and do look for a pullback after such a big move but do respect the trend and history.

Good luck out there!

What's been said:

Discussions found on the web: