Macro Factors and their impact on Monetary Policy

the Economy, and Financial Markets

MacroTides.newsletter@gmail.com

Investment letter March 18, 2012

;

When Will Volatility Increase?

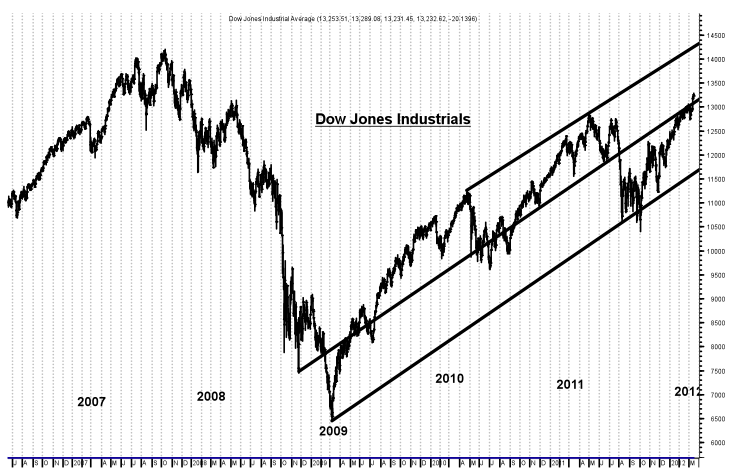

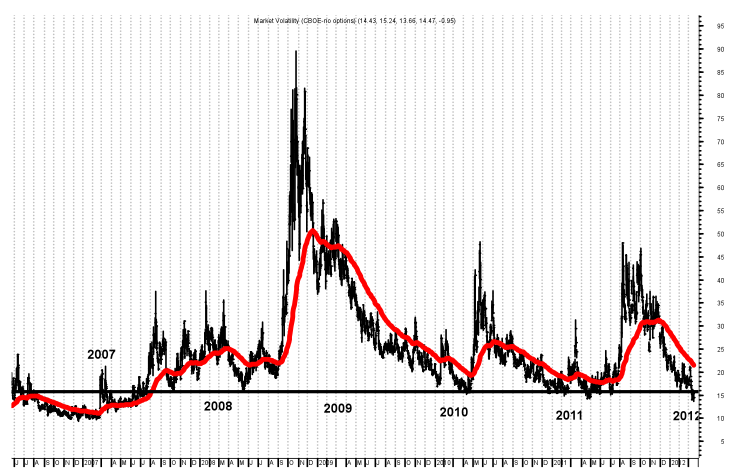

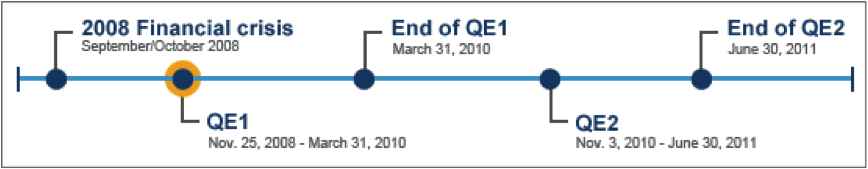

Volatility rises and falls in response to stock market trend changes, which are created when investors’ expectations of the future are not realized. The largest market moves occur as the gap between perception and reality is closed, as we’ve discussed previously. In late 2007, expectations were that the U.S. economy might slow, but there would be no recession and the rest of the world would decouple from the U.S. When those expectations proved ridiculously wrong, the gap between perception and reality was closed violently, resulting in a huge spike in volatility. (Chart pg.2) At the lows in March 2009, ‘hope’ was being treated as a four letter word, with perception dominated by despair. When reality proved the sun would come out tomorrow, the stock market rose and volatility plunged. In 2010 and 2011, investors were blindsided by the emergence of Europe’s sovereign debt crisis, which caused volatility to pop, and then recede as investors perceived the crisis having past. These outbreaks roughly coincided with the end of QE1 and QE2, which has led many to believe the end of the QE programs caused the declines. That assessment overlooks the role played by the European sovereign debt crisis.

The current low level of volatility begs the question, “Is the perception the European debt crisis is contained correct?” We don’t think so, since the primary factor driving the crisis – too much debt and too little economic growth – will worsen in 2012, especially for the countries at the center of the crisis. At some point in 2012, bond yields in Portugal, Spain, and possibly Italy will rise, as investors realize these countries are going to find it difficult to emerge from recession and lower their debt to GDP ratios and budget deficits. The tipping point will come when investors begin to compare the increase in yields in these countries to Greece’s experience. The volatility index will remain low until investor’s perceptions are confronted with this reality. We don’t know if it will take two months or six months. Home prices peaked in the U.S. in the summer of 2006, but it was more than a year later before investors realized it would lead to a crisis. Investors don’t sell stocks because the VIX is low. They sell when reality does not support their expectations. The current low level of volatility suggests another gap is developing between perception and Europe’s economic reality.

˜˜˜

Central Bank Balance Sheets

Since the financial crisis in 2008, every major central bank around the world has expanded its balance sheet significantly to prevent a deflationary financial collapse. Many observers have concluded that central bank balance sheet expansion is the equivalent of printing money. It is not. If a large portion of the money sitting on central bank balance sheets was entering the economy through a surge in bank lending, it would have inflationary potential, as too much money chased too few goods. Currently, there is too little demand chasing too many goods in all the developed countries, while growth is slowing in China, Brazil, and India. In the U.S., the velocity of money is the lowest in 50 years, so the money that is in the economy is not turning over. People are just not spending as they have in the past. GDP = (velocity * money).

Since the financial crisis in 2008, every major central bank around the world has expanded its balance sheet significantly to prevent a deflationary financial collapse. Many observers have concluded that central bank balance sheet expansion is the equivalent of printing money. It is not. If a large portion of the money sitting on central bank balance sheets was entering the economy through a surge in bank lending, it would have inflationary potential, as too much money chased too few goods. Currently, there is too little demand chasing too many goods in all the developed countries, while growth is slowing in China, Brazil, and India. In the U.S., the velocity of money is the lowest in 50 years, so the money that is in the economy is not turning over. People are just not spending as they have in the past. GDP = (velocity * money).

European Union

The sovereign debt crisis developed because a number of countries had too much debt and too little growth to support their debt loads. In the wake of the financial crisis, many countries were forced to run large budget deficits, which drove their debt levels above the key breaking point of 90% of GDP. When the recovery from the 2008 financial crisis proved weak, global investors in 2010 realized that Ireland and Greece would not be capable of paying back their accumulated debt. As global investors shunned Greece’s debt in 2011, its interest cost rose to unsustainable levels, triggering the need for a second bailout. Irrespective of all the fanfare, Greece’s bailout allowed it to default on $100 billion of its debt, so it could receive a loan for $130 billion.

Sadly, the austerity measures being imposed will deepen the economic contraction overwhelmingly Greece. The bi-annual survey by the Small Enterprises Institute, representing almost 800,000 businesses throughout Greece, found that 55% of small entrepreneurs think they will be unable to avoid bankruptcy. In 2011, there were 105,000 small business failures, and another 55,000 are expected to close this year. More than 70% of owners have used private savings to finance their businesses as bank credit dried up. Over 30% said they are behind on payments to suppliers, utilities, and social security funds. According to the survey, 244,000 jobs could be lost this year, with only 1 worker hired for every 7 workers laid off. We expect another bailout will be needed, unless Greece chooses to leave the Euro first.

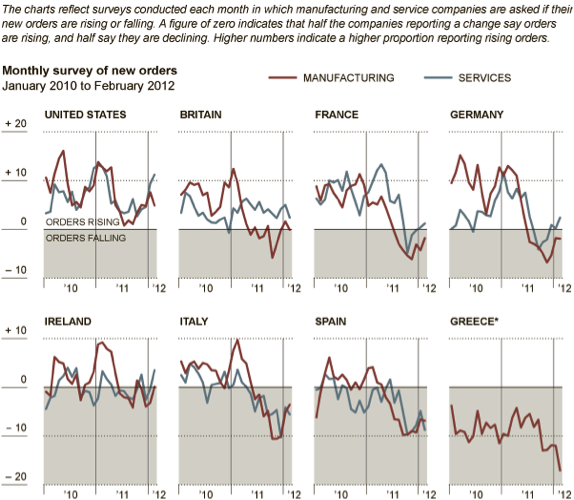

The European Central Bank has trimmed its 2012 estimate of GDP from +.3% to a slight contraction. If accurate, the European Union will be in recession for most of 2012. However, their broad estimate masks the fundamental issue of the sovereign debt crisis. The weakest countries, Greece, Portugal, Spain and Italy, will all be in a deeper recession, which will only worsen their debt to GDP ratios. A review of new orders for manufacturing and service companies shows the disparity within the E.U. and the U.S. Greece is still in freefall, while Italy and Spain have bounced from the depths of the fourth quarter, but are still quite negative. Britain and Ireland are stable, with manufacturing near zero and showing positive a reading for services. New orders for manufacturing in both France and Germany are negative, which is a bit of a surprise. New orders for services are modestly positive in both countries.

The European Central Bank has trimmed its 2012 estimate of GDP from +.3% to a slight contraction. If accurate, the European Union will be in recession for most of 2012. However, their broad estimate masks the fundamental issue of the sovereign debt crisis. The weakest countries, Greece, Portugal, Spain and Italy, will all be in a deeper recession, which will only worsen their debt to GDP ratios. A review of new orders for manufacturing and service companies shows the disparity within the E.U. and the U.S. Greece is still in freefall, while Italy and Spain have bounced from the depths of the fourth quarter, but are still quite negative. Britain and Ireland are stable, with manufacturing near zero and showing positive a reading for services. New orders for manufacturing in both France and Germany are negative, which is a bit of a surprise. New orders for services are modestly positive in both countries.

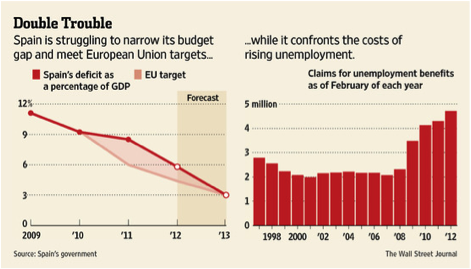

With GDP of $1.4 trillion, Spain is the world’s twelfth largest economy. Overall unemployment is 23%, with unemployment pushing 40% for those under 25. Spanish banks cut lending by 3.3% in December from a year ago, the largest decline since the Bank of Spain started tracking these numbers in 1962. Bankruptcies rose 12% in 2011, according to Informa D&B. Spain reduced its budget deficit to 8.5% in 2011, but that was well above its EU target of 6.0%. In January, Spain signed an agreement as a member of the European Union to cut its 2012 deficit to 4.4% of GDP. In order to reach that target, Spain will have to reduce government spending by $52.3 billion, according to Moody’s, versus the $28 billion in cuts that were spread out over 2010 and 2011. Two weeks ago, Prime Minister Mariano Rajoy said Spain would aim to reduce its deficit to 5.8%, well above its 4.4% EU target. “This is a sovereign decision made by Spain.” Translation: “We will not allow the EU (Germany) to dictate to Spain how to run our economy.” Spanish trade unions, which represent 20% of Spain’s total work force, announced they will hold a general strike on March 29, against labor market reforms they called “…the most regressive in the history of Spanish democracy.” Spain’s real estate woes and weak growth are hurting bank balance sheets. Bad debts share of overall bank portfolios rose to 7.61% in December, the highest since 1994.

With GDP of $1.4 trillion, Spain is the world’s twelfth largest economy. Overall unemployment is 23%, with unemployment pushing 40% for those under 25. Spanish banks cut lending by 3.3% in December from a year ago, the largest decline since the Bank of Spain started tracking these numbers in 1962. Bankruptcies rose 12% in 2011, according to Informa D&B. Spain reduced its budget deficit to 8.5% in 2011, but that was well above its EU target of 6.0%. In January, Spain signed an agreement as a member of the European Union to cut its 2012 deficit to 4.4% of GDP. In order to reach that target, Spain will have to reduce government spending by $52.3 billion, according to Moody’s, versus the $28 billion in cuts that were spread out over 2010 and 2011. Two weeks ago, Prime Minister Mariano Rajoy said Spain would aim to reduce its deficit to 5.8%, well above its 4.4% EU target. “This is a sovereign decision made by Spain.” Translation: “We will not allow the EU (Germany) to dictate to Spain how to run our economy.” Spanish trade unions, which represent 20% of Spain’s total work force, announced they will hold a general strike on March 29, against labor market reforms they called “…the most regressive in the history of Spanish democracy.” Spain’s real estate woes and weak growth are hurting bank balance sheets. Bad debts share of overall bank portfolios rose to 7.61% in December, the highest since 1994.

In 2011, Portugal’s economy contracted by 1.6%, but shrank at a 2.8% annual rate in the fourth quarter. In December, lending to the private sector fell 3.5% from a year ago. Bankruptcy filings by companies and individuals rose more than 50% last year and have continued to rise this year, according to the Portuguese Association of Bankruptcy Administrators. Citigroup has forecast Portugal’s economy will shrink 5.5% in 2012. In January, unemployment reached 14.8%, and will likely climb during 2012. With GDP falling and its economy shrinking, its debt to GDP ratio will climb to 118% from 107% last year.

The International Monetary Fund estimates that Italy’s economy will shrink by 2.2% in 2012. Prime Minister Mario Monti introduced a “Grow Italy” bill to open up competition, reduce red tape, and bureaucratic barriers to growth that special interest groups have relied upon for a long time. Mr. Monti was forced to water down his bill, after special interest groups successfully engaged in a bout of arm twisting. Italy’s debt to GDP ratio is 120%, and is desperate to increase tax revenue. How desperate? In February, Italy announced plans to change Italian law to ensure that the Roman Catholic Church pays property taxes on buildings used commercially. If adopted, tax revenue could be $650 million to $2.6 billion annually.

The biggest headwind facing Europe is the contraction in bank lending. As we have noted previously, bank lending in Europe represents 80% of credit creation, versus 35% in the U.S. Although the two LTRO operations by the ECB prevented a full scale liquidity crisis, they haven’t spurred an immediate increase in lending, and we don’t expect that to change until the third quarter at the earliest. Loan demand from strong companies, which the banks would love to extend credit, will remain tepid until a real recovery in Europe is in sight. With the EU in recession, banks will naturally be reluctant to lend to those medium and small firms that are struggling and need credit. This will affect small and medium sized businesses disproportionately, and result in a rise in corporate bankruptcies throughout Europe. The majority of banks in Europe need to increase capital ratios and additional lending makes that more difficult. This means many banks in Europe have an incentive not to lend in coming months. Given the current challenging environment, European banks will continue to be more interested in playing defense, which will make it difficult for Europe to pull out of its recession.

Going forward, the key metrics worth monitoring will be bank lending and yields in Portugal, Spain, and Italy. The LTRO operations have been successful in brining sovereign yields down significantly, which is certainly positive. We expect yields to reverse once it becomes apparent that the fiscal and economic conditions are not improving. If yields do rise and investors begin to compare Spain or Portugal to Greece, the bell will ring for the third round of Europe’s sovereign debt crisis. We don’t know if this will take two months or six months, but feel it’s just a matter of when, not if.

U.S. Economy

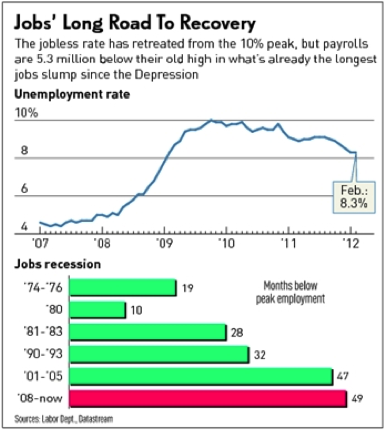

Job growth has improved, especially over the last three months, when it averaged 245,000 jobs versus 160,000 in the three prior months. Retail sales have also been decent. Core retail sales, which excludes sales of gasoline, autos, and building materials, were up .5% in February, after increasing 1.0% in January. Lending by U.S. banks has modestly increased. Consumer and small business confidence have also risen in recent months. Despite these encouraging reports, we think intermediate and long term challenges will prevent the economy from accelerating from current levels, as it has during ‘normal’ post World War II recoveries. As this growth spurt loses steam, we believe a gradually slowing will take hold by late summer. In addition, some of implied strength during the last few months may be the result of statistical variability, rather than actual demand.

Most of the economic reports we receive are not based on raw data. Government number crunchers seasonally adjust the raw data to smooth out recurring seasonal variations in the data. For instance, there are more homes sold during the summer than in winter. Retailers hire aggressively in the fall to handle the holiday sales stampede, and let most of the workers go in January. We do not think there is anything sinister going on, i.e., skewing the data to favor one political party over another, or make the economy look better. Adjusting the raw data is an honest attempt to make the information meaningful over time, so a more accurate appraisal can be made as to the economy’s health.

This winter has been the fourth mildest on record, according to the National Weather Service. The affect of this deviation from the ‘average’ winter is likely giving the raw data an extra boost, based on normal seasonal adjustments. More people are out shopping or eating in a restaurant since it is 50 degrees, rather than staying warm at home, as they would normally when it’s 15 degrees in February.

Seasonal adjustments are also impacted by outlier data points, when compared to prior data. In the fourth quarter of 2008 and first quarter of 2009, the U.S. economy experienced an extremely large decline that affected all the data sets, when compared to the fourth and first quarters of preceding years. The formulas used to measure activity in subsequent years are compared to an average of prior fourth and first quarters. This skew in the prior data will have the effect of making the subsequent years look better than they really are, until time removes the negative impact of the data from 2008 and 2009. This statistic anomaly has likely adjusted the raw data higher in the fourth and first quarters in 2010, 2011, and 2012. This dynamic suggests the second and third quarter of 2012 will not benefit from this statistical lift, and, as a result, will register slower growth, even if growth is maintained at first quarter levels.

Seasonal adjustments are also impacted by outlier data points, when compared to prior data. In the fourth quarter of 2008 and first quarter of 2009, the U.S. economy experienced an extremely large decline that affected all the data sets, when compared to the fourth and first quarters of preceding years. The formulas used to measure activity in subsequent years are compared to an average of prior fourth and first quarters. This skew in the prior data will have the effect of making the subsequent years look better than they really are, until time removes the negative impact of the data from 2008 and 2009. This statistic anomaly has likely adjusted the raw data higher in the fourth and first quarters in 2010, 2011, and 2012. This dynamic suggests the second and third quarter of 2012 will not benefit from this statistical lift, and, as a result, will register slower growth, even if growth is maintained at first quarter levels.

Our expectation of a gradual slowdown though extends beyond seasonal adjustments. In prior post World War II recoveries, job growth would be averaging 350,000 jobs or more, forty four months after a recession ended, and all the lost jobs would have been recovered. Although the last three months of job growth have been good, there are still 5.3 million workers out of work. The average work week was unchanged in February, so the need to hire additional workers is not high. More importantly, average hourly earnings were up only 1.9% from a year ago. The cost of living has increased more, so the purchasing power of the 132 million consumers who have jobs is less than a year ago, which outweighs by far the modest improvement in job growth.

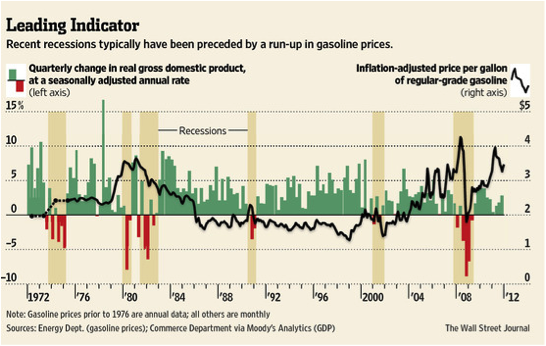

The price of gasoline has jumped in the last six months, with the national average for regular unleaded reaching $3.83 last week. Fortunately, the mild winter kept heating oil prices down and an excess of natural gas pushed prices to ten year lows. According to estimates by the Energy Information Administration, the additional $14.8 billion shelled out by consumers since last October, was partially offset by the $9.0 billion saved from the other energy sources. However, with the summer driving season right around the corner, higher gasoline bills won’t be offset by other energy savings. Expectations of higher gas prices, is already dimming consumer optimism, according to the IBD/TIPP Optimism Index. If gasoline prices push higher during the summer driving season, as they usually do, consumers will have less spending money.

The price of gasoline has jumped in the last six months, with the national average for regular unleaded reaching $3.83 last week. Fortunately, the mild winter kept heating oil prices down and an excess of natural gas pushed prices to ten year lows. According to estimates by the Energy Information Administration, the additional $14.8 billion shelled out by consumers since last October, was partially offset by the $9.0 billion saved from the other energy sources. However, with the summer driving season right around the corner, higher gasoline bills won’t be offset by other energy savings. Expectations of higher gas prices, is already dimming consumer optimism, according to the IBD/TIPP Optimism Index. If gasoline prices push higher during the summer driving season, as they usually do, consumers will have less spending money.

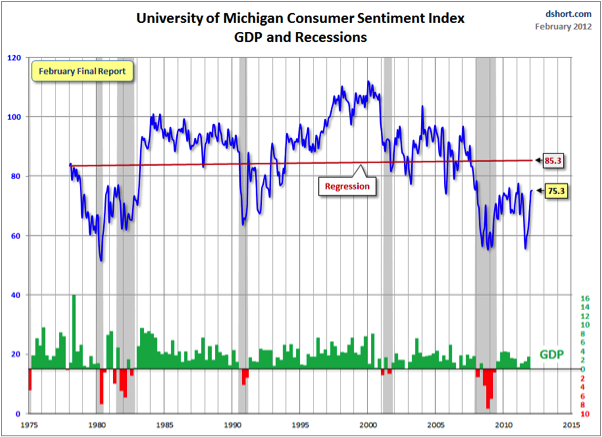

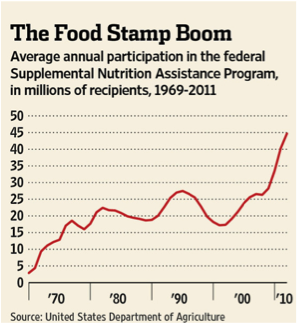

Although consumer sentiment and small business optimism have improved since last fall, they are still well below the levels associated with a normal recovery. Since 1975, the Michigan Consumer Sentiment Index has been comfortably above 80 when the economy has enjoyed healthy growth. The current reading of 74.3 has only occurred during periods of recession. The financial stress on the average family is reflected by the 45 million Americans participating in the Supplemental Nutrition Assistance Program. Of the 311 million people in this country, 14.6% are relying on Food Stamps. Since 1986, recessions have been coincident when the Small Business Optimism Index has been below 95. Even after months of improvement it is still comfortably below that threshold.

Although consumer sentiment and small business optimism have improved since last fall, they are still well below the levels associated with a normal recovery. Since 1975, the Michigan Consumer Sentiment Index has been comfortably above 80 when the economy has enjoyed healthy growth. The current reading of 74.3 has only occurred during periods of recession. The financial stress on the average family is reflected by the 45 million Americans participating in the Supplemental Nutrition Assistance Program. Of the 311 million people in this country, 14.6% are relying on Food Stamps. Since 1986, recessions have been coincident when the Small Business Optimism Index has been below 95. Even after months of improvement it is still comfortably below that threshold.

We expected the economy to get a lift in the fourth quarter of last year from the investment tax credit that allowed companies to write off 100% of business investments completed by December 31. We assumed this incentive would pull demand forward from early 2012 into 2011, and result in a dip in the first half of this year. Although the ISM manufacturing index is still above 50, which delineates growth and contraction, it did drop in February, after climbing from a low last July. This may prove a foreshadowing of the gradual slowing we expect.

State and local government finances have improved significantly since 2010, as states raised taxes, cut costs to close budget deficits, and an improved economy lifted tax receipts. Since mid-2008, state and local governments have reduced their collective payrolls by 647,000. Despite these actions, state and local governments face a shortfall of $47 billion for their 2013 budget which begins on July 1. In order to balance their budgets, as mandated by law, more tax increases and job cuts will be implemented and have a small drag on the economy in the second half of this year.

State and local government finances have improved significantly since 2010, as states raised taxes, cut costs to close budget deficits, and an improved economy lifted tax receipts. Since mid-2008, state and local governments have reduced their collective payrolls by 647,000. Despite these actions, state and local governments face a shortfall of $47 billion for their 2013 budget which begins on July 1. In order to balance their budgets, as mandated by law, more tax increases and job cuts will be implemented and have a small drag on the economy in the second half of this year.

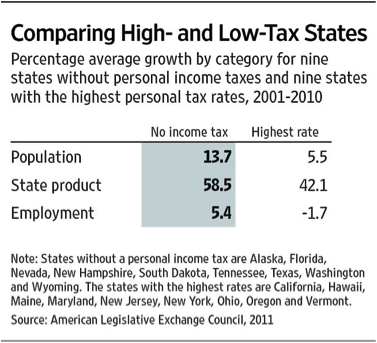

Ironically, some of the large budget deficit states also have the highest rates of unemployment, and high taxes. Clearly, state tax rates do matter. If workers have a degree of mobility, they will gravitate to states that have no taxes or low taxes, as will the companies that employ them. The migration of labor away from high tax states makes it even more difficult for them to balance their budgets, as tax revenue growth is too weak to offset spending increases. The experience from 2001-2010 shows how significant this has been.

In 2010 and 2011, exports grew 15%, adding more than 1% to GDP growth. As noted last month, Europe is our largest trading partner representing 20% of exports. In January, exports to Europe fell 7.5%. We don’t expect Europe to rebound anytime soon. Although China, South Korea, Brazil, and India will continue to grow in 2012, their growth rates will be slower than in 2010 and 2011. This suggests that export growth is not likely to accelerate from current levels.

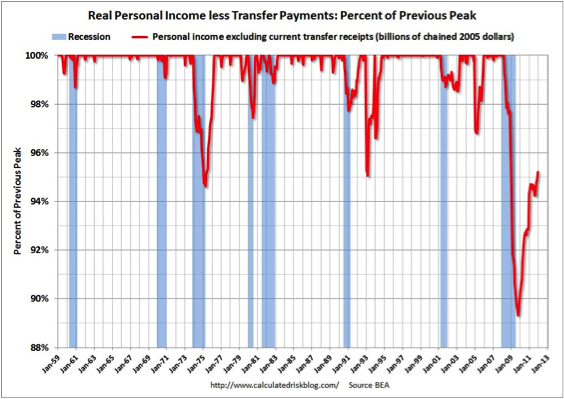

Of the 11 prior recessions and recoveries since World War II, the current expansion has been the weakest by far. Real personal income is still more than 4% below its pre-recession level, even though it’s been 32 months since the recovery began in June 2009. The overall economy as measured by GDP has been sustained by an unprecedented level of income transfers that have supported consumer spending. For every $1.00 of total personal income, the federal government is providing almost $.20, financed with trillion dollar deficits. This is so obviously unsustainable, but the will to address the coming budgetary crisis in the U.S. is lacking. We are following the same path taken by Greece, and it’s no Yellow Brick Road.

Of the 11 prior recessions and recoveries since World War II, the current expansion has been the weakest by far. Real personal income is still more than 4% below its pre-recession level, even though it’s been 32 months since the recovery began in June 2009. The overall economy as measured by GDP has been sustained by an unprecedented level of income transfers that have supported consumer spending. For every $1.00 of total personal income, the federal government is providing almost $.20, financed with trillion dollar deficits. This is so obviously unsustainable, but the will to address the coming budgetary crisis in the U.S. is lacking. We are following the same path taken by Greece, and it’s no Yellow Brick Road.

China

We continue to expect China to avoid a hard landing, since its central bank will lower rates and reduce bank reserve rates to free up reserves as they did in February. However, the deceleration in China’s growth rate will not come without additional risks to its economy and potential social problems.

We continue to expect China to avoid a hard landing, since its central bank will lower rates and reduce bank reserve rates to free up reserves as they did in February. However, the deceleration in China’s growth rate will not come without additional risks to its economy and potential social problems.

China is embarking on an audacious program to shift from its reliance on exports and internal fixed infrastructure investment for economic growth, to a greater dependence on domestic consumption. This transition will take at least a decade to accomplish. Consumer spending in the U.S. accounts for 70% of GDP, while it is just 35% in China. Between 2000 and 2010, fixed investment averaged 13.3%, as China expanded its export production capacity and infrastructure spending. During the same period, consumer demand averaged 7.8%. As a result, fixed investment rose to 46% of GDP, while consumer consumption fell to 35%.

In order to increase domestic consumption, incomes for the average Chinese worker must increase. In 2011, 24 provinces increased wages by an average of 22%. In April, the minimum wage in Shanghai is set to rise by 13% to $230 a month. According to China’s Five Year plan, wages are expected to rise by 13% per year through 2015. While higher wages are good for Chinese workers and will lead to an increase in domestic consumption, they will also push China’s inflation higher. China’s central bank will face a challenge in balancing these opposing forces.

In an ideal scenario, Chinese export growth would remain strong in coming years as China boosts domestic consumption. That is not what is happening. Europe is China’s largest export market. In February, exports to Europe were down 1.1% compared to a year ago, rather than the normal double digit gain. The annual gain in exports to the U.S. also slipped, rising 14.9% in February from December’s annual gain of 17.4%. Higher wages in China will also mean the loss of the competitive advantage China has long enjoyed, as workers in Malaysia, Vietnam, and Indonesia will increasingly be able to produce goods for less than China. China’s export machine is being squeezed from the top by slow growth in the U.S. and no growth in the EU, and from the bottom by lower cost producers around the world. The Chinese Economy Minister said boosting exports this year by 10% would require “arduous efforts”, an acknowledgement of the tough export environment China faces.

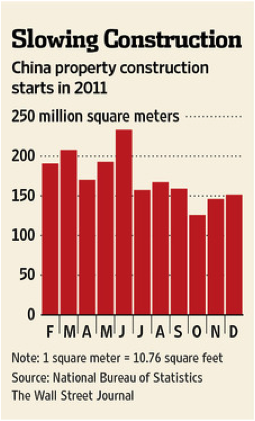

Internally, China is confronting a deflating housing bubble, which emerged after a huge lending spree in the wake of the 2008 financial crisis. Slowly but inexorably real estate values are slipping in its major cities. In response to calls to reverse current policy and support real estate values, Premier Wen said home prices remained too high and existing curbs were necessary to avoid “chaos”. With housing costs too expensive for the average worker, the risk of social unrest will remain high. Lower housing costs would help the average worker, but not China’s banks.

Internally, China is confronting a deflating housing bubble, which emerged after a huge lending spree in the wake of the 2008 financial crisis. Slowly but inexorably real estate values are slipping in its major cities. In response to calls to reverse current policy and support real estate values, Premier Wen said home prices remained too high and existing curbs were necessary to avoid “chaos”. With housing costs too expensive for the average worker, the risk of social unrest will remain high. Lower housing costs would help the average worker, but not China’s banks.

Slower export growth and the resulting excess capacity, which is not being offset by current domestic demand, combined with falling real estate and land values will pose significant risks for China’s banking system in the next two years. Although China is likely to avoid a hard landing in 2012, the risks are to the downside, especially in 2013.

Stocks

U.S. multi-national companies are going to feel the effects of the recession in Europe, and slowing in developing countries. We would expect an increase in the number of companies that issue earnings warnings. With institutional investors eager to preserve a year’s worth of gains packed into the first quarter, the urge to book some profits may be triggered if a number of key companies temper the bullish outlook. In January, corporate insiders were selling 8 times the dollar amount of their purchases. In February, they upped the ante, selling $6.8 billion of their companies stock, versus $510 million of purchases. February was the sixth month in a row insiders bought less than $1 billion of their stock. For each $1 purchased in February, they sold $13.00. Why are they selling so aggressively, when the majority of investors are uniformly bullish? With sales growth slipping in developing countries and negative in a large part of Europe, profit margins may be pressured. Weak employment growth in 2010 and 2011 allowed companies to keep their costs down and fatten their profit margins well above the historical average of 7.2%. It wouldn’t be the end of the world if margins slipped a little, but it wouldn’t be a positive.

Prior to the sharp sell off on March 5, the S&P had gone 50 days without touching its 20-day average. According to McMillan Analysis, at 44 days, the streak was “one of the five longest of all time.” This statistic quantifies just how rare the trading pattern was during January and February. It is a reflection of strength, but it also underscores the dearth of bad news, which has kept selling pressure non-existent. That will change in coming months, if our analysis of Europe is on target.

In our February 1 Special Update, we suggested selling into strength as the S&P pushed above 1340. The S&P has pushed 5% higher since then, which does not make us happy. The fact it took a trading event that has only occurred on literally just a handful of occasions in the last 80 years is a small consolation.

We expected the S&P to experience a pullback of 4% to 7% based on the high level of bullish sentiment, insider selling, and weakening technical indicators. We thought the correction would be similar to the 5.1% set back in December. Instead, the ‘decline’ was just 2.75%, and reversed after the March 5 sell off. We advised aggressive investors to go short the S&P by buying the ETF SH at an average price of 1345 on the S&P. That trade was stopped out when the S&P traded above 1378 for a 2.45% loss.

The rally from the low on March 5 is completing a 5 wave trading pattern from the December 20 low. The market is again ripe for a pullback of 4% to 7%, which could carry the S&P down to 1340-1350. If selling pressure does not pick up substantially on this pullback, we would expect the S&P to rally back to 1440-1449, which is where the S&P topped in May 2008. There is also a price target of 1493 that we’ll discuss in greater detail next month.

Dollar

Maintain the stop on UUP at $21.70.

Gold

As expected, gold did not rally above 4184, and has dropped from $1792 to under 41650, after posting a monthly key reversal in February. Gold is oversold, so a bounce is due. For now, we’ll see how gold trades, since we think a decline to $15250$1550 is still possible.

Bonds

The bond market got whacked after the Federal Reserve upgraded their assessment of the economy, and investors concluded that QE3 was off the table. We were a bit caught off guard by the extent of the decline and jump in interest rates. It should be obvious that QE3 is on the back burner as long as job growth is above 200,000 a month. It should also be obvious that QE3 will be front and center if Europe fades and begins to affect the U.S. economy. Looming tax increases in 2013 is the main reason the Fed has said it will keep rates low until 2014. They understand the drag on the economy that will occur if we do our version of austerity. QE3 is their ace in the hole, and they don’t want to play it until they need to wage another battle against deflation.

Honestly, we don’t know if a secular turn in the bond market has occurred. Given our deficits and the fact we haven’t had a budget in three years, it’s easy to see why global investors might start questioning our resolve (lack of leadership) to address our budgetary largesse, and back away from Treasury bonds. We remain unconvinced the U.S. economy has achieved a sustained growth path and expect Europe’s debt problems to resurface, which should provide bonds a bid. It’s just a question of how long it will take for this to play out. Technically, the decline in TLT since peaking at $125.03 could be an A (down)-B (up)-C (down). The C wave decline would be equal to A at $108.81. If this pattern analysis is correct, Treasury bonds will eventually exceed $125.03. If a secular turn has indeed taken hold, 30-year Treasury yields could breach 4.0%, as TLT drops to $98.00. Last month, we recommended buying TLT in three stages, $117.23 (open on 2/24), at $113.91 after closing below $115.49, and below $112.85. The average is $114.66. Use a close below $108.50 as a stop. We think TLT can bounce back to $114.00 or higher in coming weeks.

What's been said:

Discussions found on the web: