My afternoon train reading:

• Are Millionaires Pulling Out of Stocks? (WSJ) see also How The Rich Spend Their Money (Barrons)

• Bill Gross on The Great Escape: Delivering in a Delevering World (Pimco)

• Face Time With Facebook CEO Stirs Concerns on Wall Street (NYT) see also Facebook Says Negative Outcome of Yahoo Suit May Be Material (Bloomberg)

• Apple TV beckons as jackpot in Hon Hai’s Sharp gamble (Reuters)

• Banking Regulator Calls for End of ‘Too Big to Fail’ (DealBook) see also Foreclosure Deal Credits Banks for Routine Efforts (NYT)

• More US drilling didn’t drop gas price (Minnesota Public Radio)

• Nudge nudge, think think (Economist) see also Habit: Can’t Help Myself (NYT)

• The Long History of American Health-Care Fights (Bloomberg)

• Next Big Idea: Jeff Koons’ ‘Train’ at the High Line (High Line)

• NY’s Financial Media Heavyweights Partied For JB’s ‘Backstage Wall Street’ (Business Insider)

What are you reading?

>

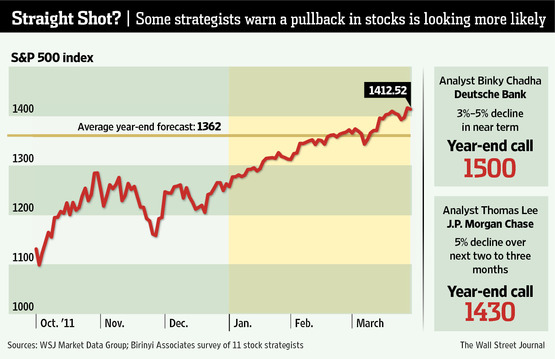

Bulls Show Their Bearish Side

Source: WSJ

What's been said:

Discussions found on the web: