Some reads to start your week:

• Secular Bear Market? (Comstock Funds) see also This Bull Market Is Hard to Pin Down (NYT)

• Water wars between countries could be just around the corner (Guardian)

• Bond Managers Divided As Treasurys Reach Fork In The Road (WSJ) see also Plans for 100-year bonds mark end of bull market, but equity bear still prowls (Independent)

• BATS Trading Error Bolsters Case for Curbs (DealBook) see also BATS Faced Revolt Over IPO (WSJ)

• Anger at Goldman Still Simmers (NYT)

• Merkel set to allow firewall to rise (FT) see also Eurozone debt crisis: Germany ‘must let bailout fund grow’ (Telegraph)

• Weekend sports stunner: Mangled Horses, Maimed Jockeys (NYT)

• Digging out of debt (LA Times) see also How Debt Bankrupts the Middle Class (Stanford University Press)

• Facebook two-fer

…..-Facebook says it may sue employers who demand job applicants’ passwords (Ars Technica)

…..-Facebook asserts trademark on word “book” in new user agreement (Ars Technica)

• The Family Hour: An Oral History of The Sopranos (VF)

What are you reading?

>

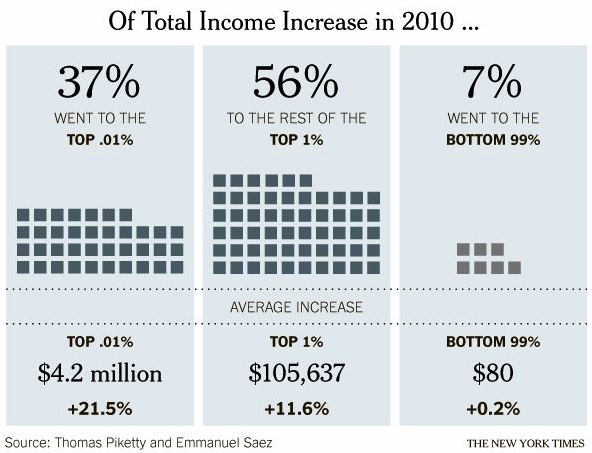

The Rich Get Even Richer

Source: NYT

What's been said:

Discussions found on the web: