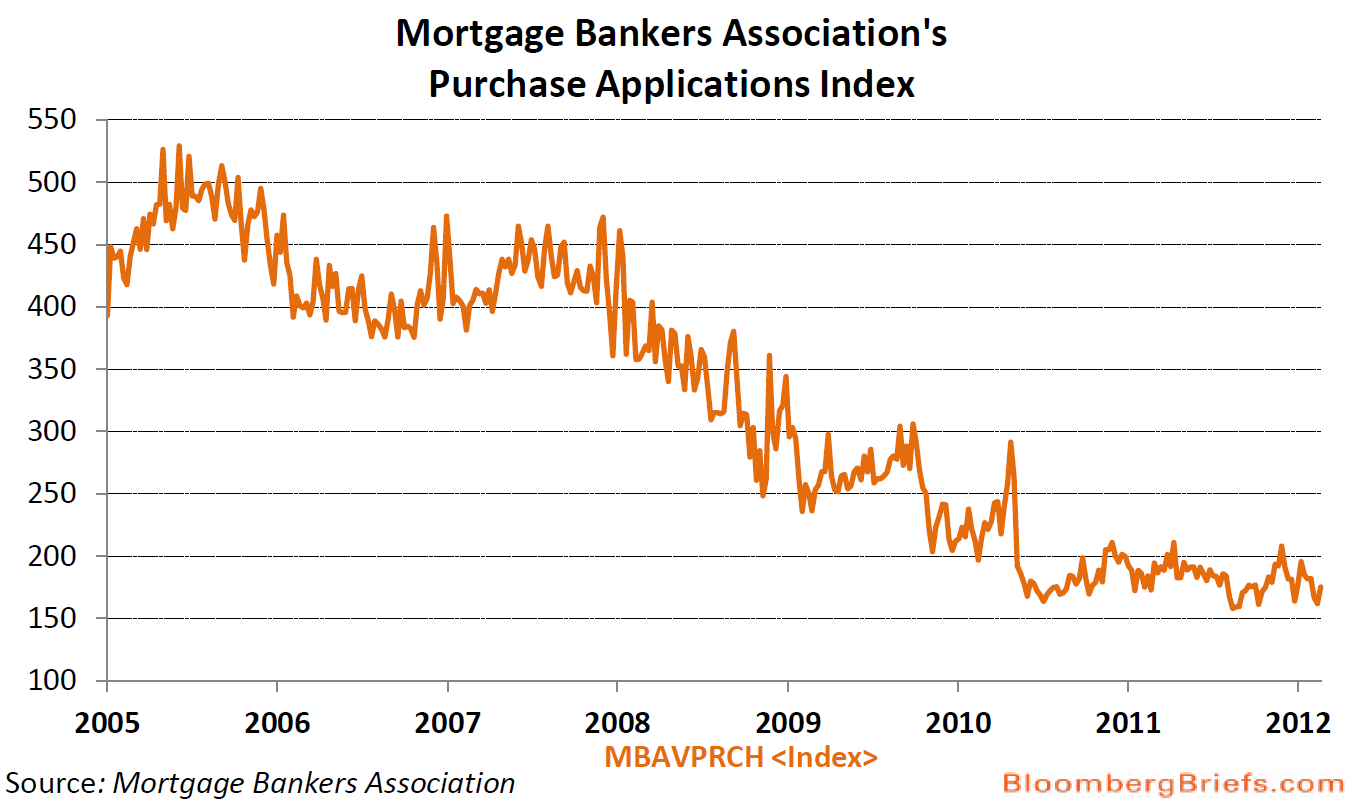

Click to enlarge:

Source:Bloomberg BRIEF, March 01, 2012

>

Richard Yamarone, Bloomberg Economist:

Month-to-month gains in several housing statistics – new and existing home sales, starts, and homebuilder confidence – has created in financial markets a sense of optimism about a housing recovery. Comments made by key players during quarterly earnings conference calls suggests such optimism is likely premature. According to Beazer Homes CEO Allan Merrill, consumers remain fearful that home prices may fall further, are worried about about the overall direction of the economy and, “with some buyers, [concerned] about the impact of potential hanges in national housing policies.”

What's been said:

Discussions found on the web: