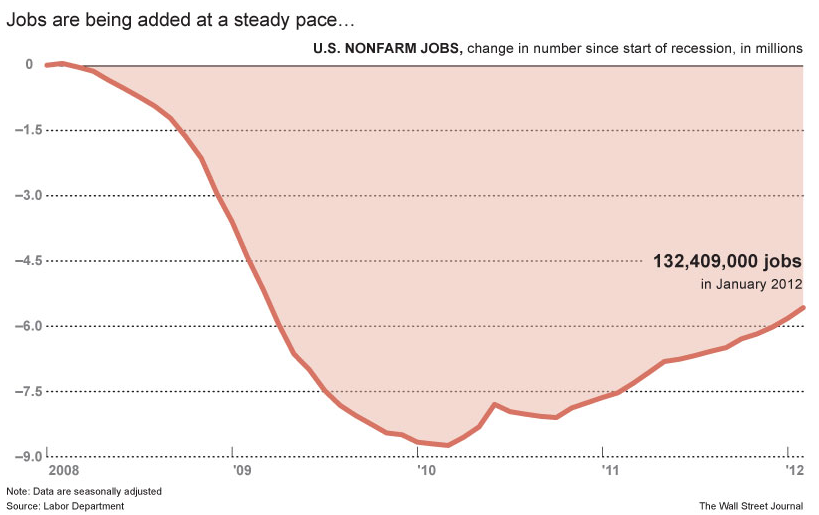

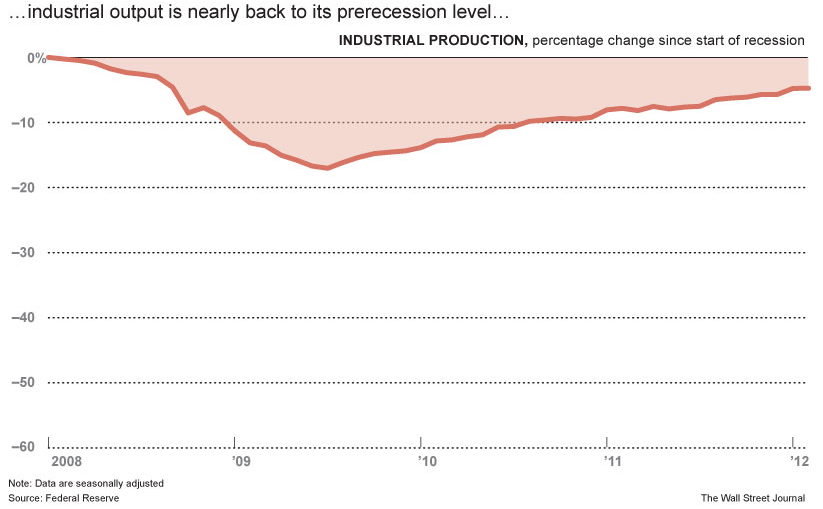

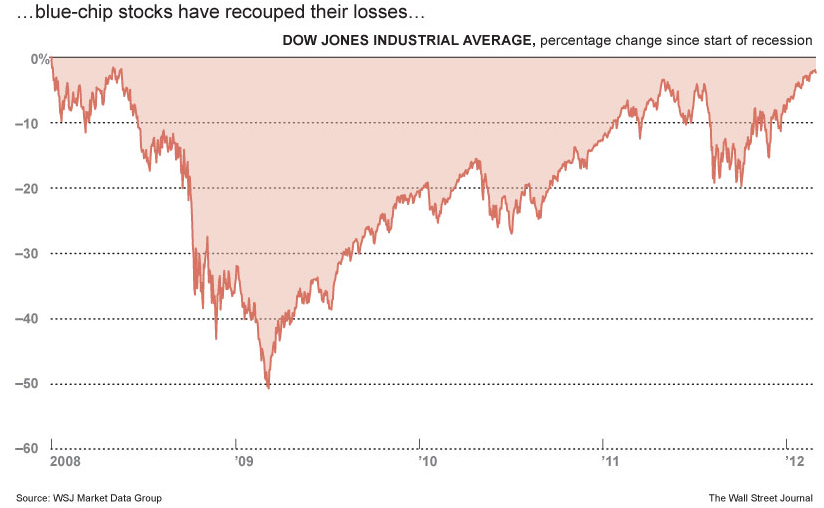

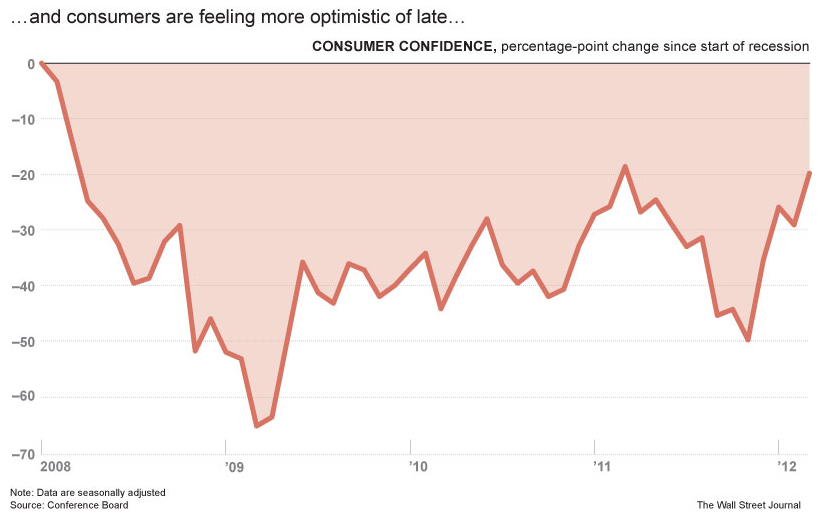

I am still unconvinced that a recession over the next 12 months is off the table.So i spend lots of time looking of evidence that argues the economy is improving.

The latest find is this set of charts in the WSJ last week:

The U.S. Economic Recovery Shows Signs of Accelerating, but Still Has Lots of Ground to Cover

More charts after the jump

Source: WSJ

What's been said:

Discussions found on the web: