My afternoon train reading:

• Hedge Fund Manager Dan Zwirn, the Man Who Fell to Earth (Businessweek)

• Dark Pools Win Record Stock Volume as NYSE Trading Slows to 1990s Levels (Bloomberg)

• Share Traders More Reckless Than Psychopaths, Study Shows (Spiegel.de) see also 10 Commandments for Con Men (Lists Of Note)

• Analysis: Critics question cost as consultants nip and tuck SEC (Reuters)

• Commodites: Bull market corrections or the start of bear markets (Peter Brandt) see also Rising Crude Prices Tap Into a Barrel of Nonsense (Bloomberg)

• Threatened Goldman Japan workers unionize (Japan Times)

• Senators target Facebook with bill that would close stock-option loophole (Washington Post)

• In the Future Everything Will Be A Coffee Shop (Speculist)

• Memory Is Not a Recording Device: How Technology Shaped Our Metaphors for Remembering (Brain Pickings)

• Bubbles at the Edge of Space: Merav Opher Is Changing Astrophysics (Txchnologist)

What are you reading?

>

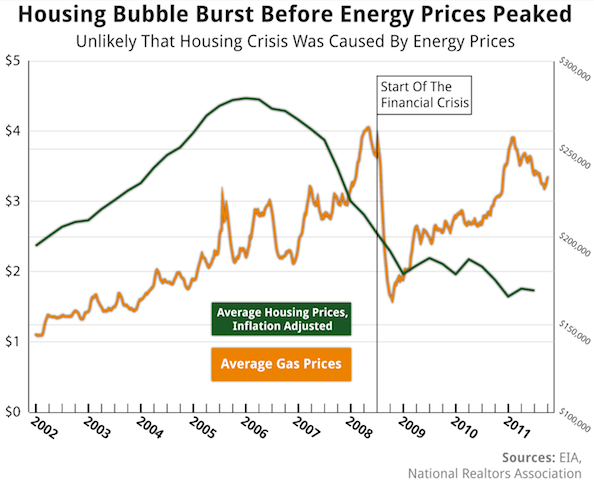

No, Rick, Energy Prices Did Not Cause the Housing Bust

Source: TPM

What's been said:

Discussions found on the web: