FusionIQ (Trader) had a market overview that went out to institutional clients and subscribers last week. What follows is an excerpt of that note. If you were on our TBP/IQ conference call last week some of this might appear familiar.

~~~

The following was written by Kevin Lane, creator of the FusionIQ algorithms:

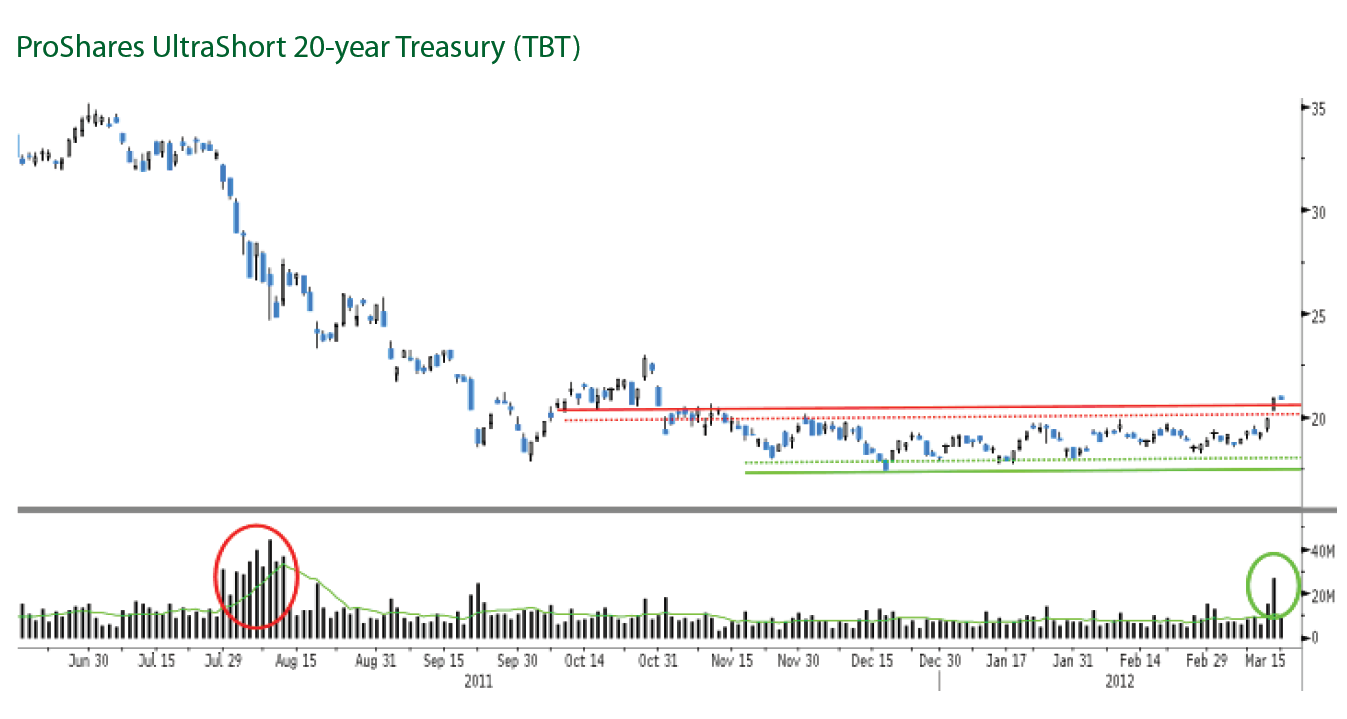

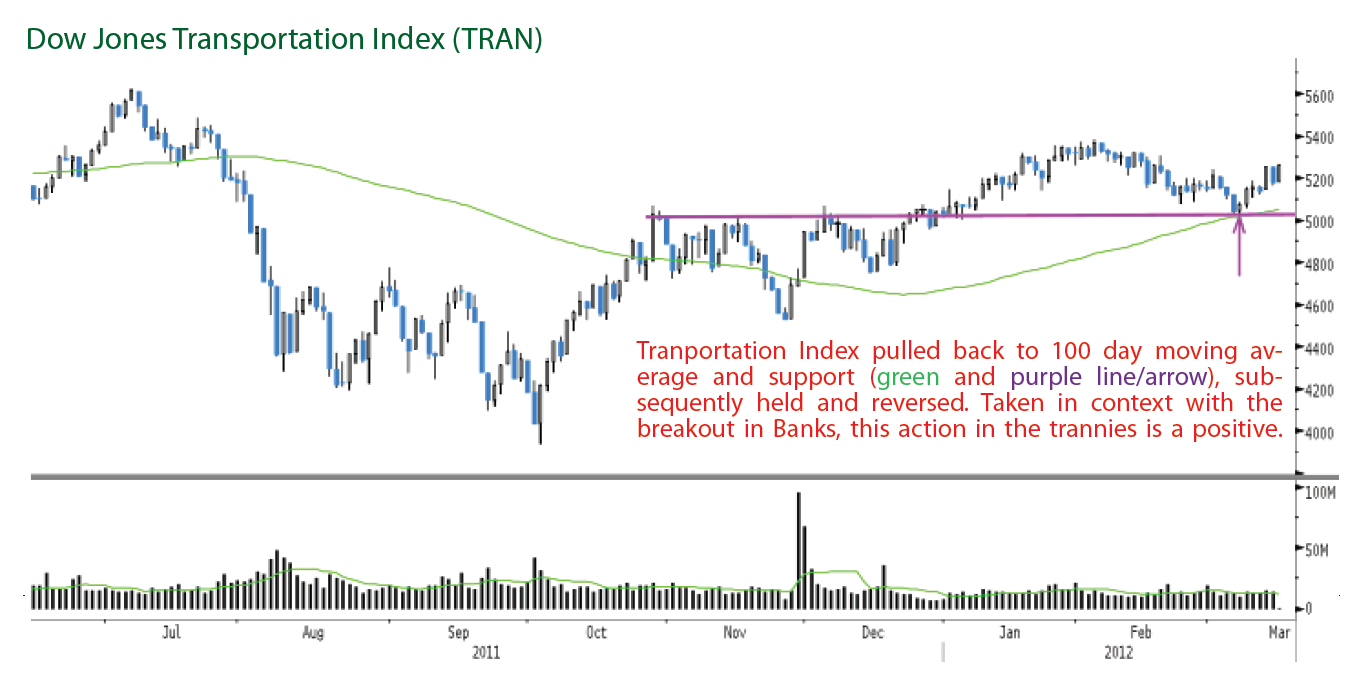

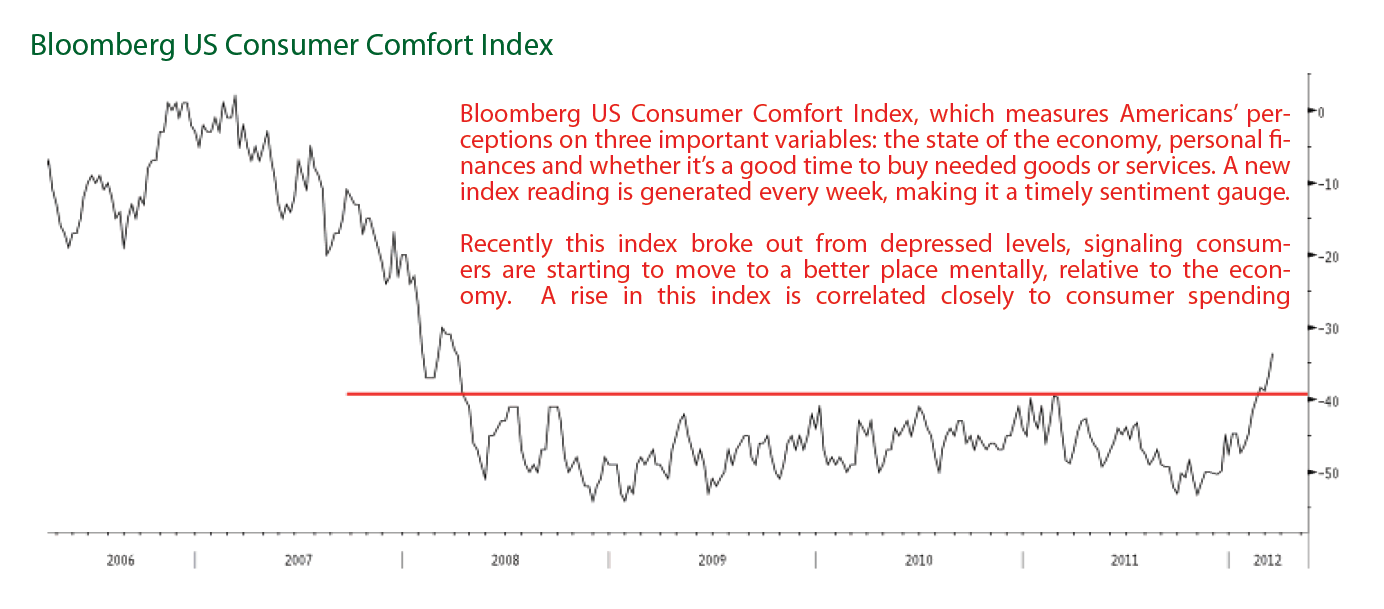

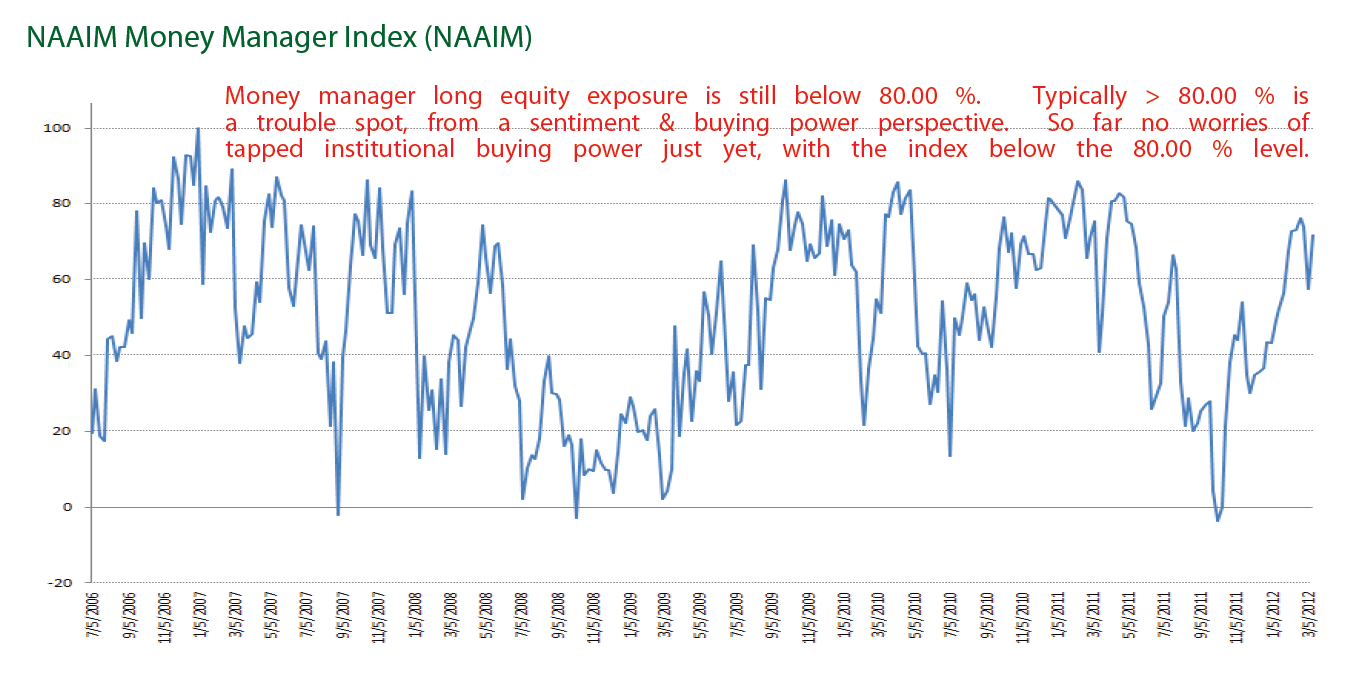

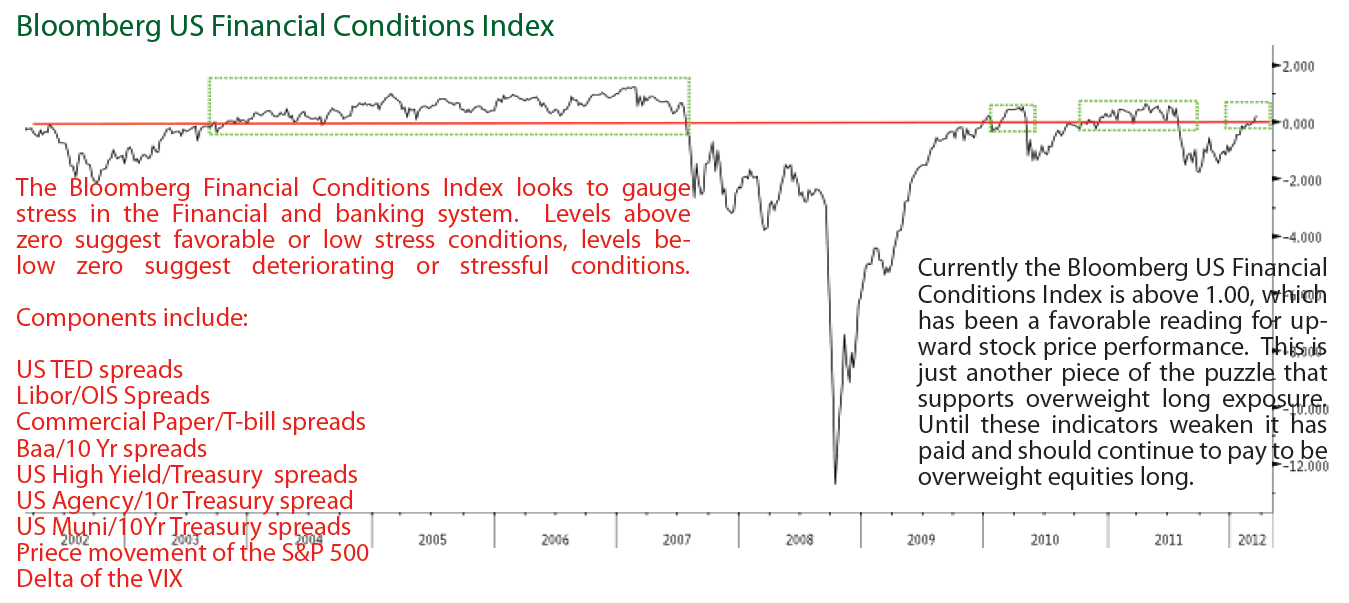

Equity market pullbacks have remained shallow and defensive havens such as Gold and Bonds are starting to correct as fund flows revert back into equities. This reallocation of asset class exposures will likely push stocks up more in the coming weeks and months. Seasonality trends for stocks still remain positive for the next few months, which is another plus. While nominal corrections can occur along the way we don’t see any major hiccups yet especially with; the economy gaining traction, liquidity for equities increasing (from bond and gold liquidations, in addition to sideline monies) and performance anxiety setting in as many managers fall deeper behind their benchmarks.

As seen in the chart below the TBT, an ETF that has 200 % inverse performance to the 20-year treasury, appears to have finally broken its bear trend with a high volume, bullish gap out of a base and above resistance (red lines). While the broad US equity markets may have some modest volatility/back and fill trading action in the coming days and weeks, we believe markets should generally move higher as investors move into risk assets in a, “I don’t want to miss the equity bus trade.” While this is not a comforting sentiment (ie investor chasing stocks), it will provide the necessary liquidty as asset flows shift into stocks. This liquidity will be the fuel that can move stocks higher, that is until it exhausts itself. Stayed tuned for updates on the latter thesis.

Click to enlarge:

˜˜˜

Source: Kevin Lane, FusionIQ

What's been said:

Discussions found on the web: