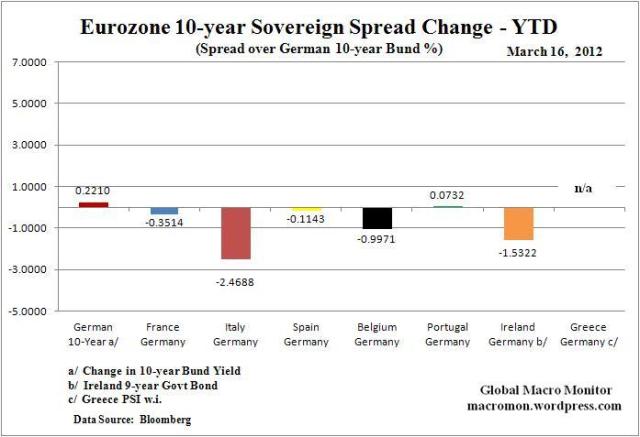

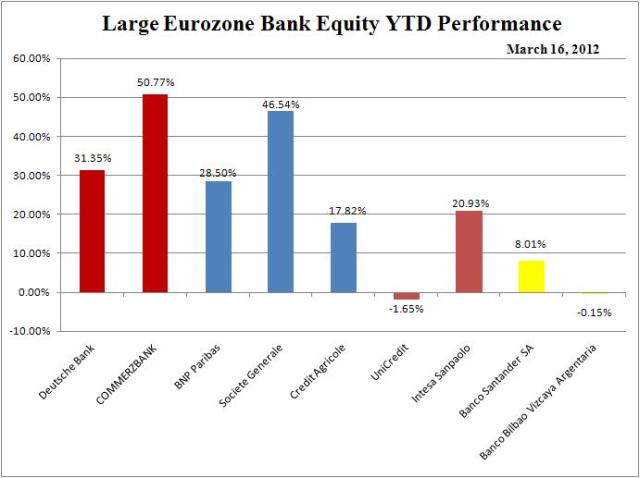

Wow! When was the last time Portugal, Italy, and Greece sovereign spreads tightened this much in one week? Spain remains a concern, however, widening 10 bps on the week even as the Bund yield increased over 25 bps. Banks rebounded smartly from last week’s spanking.

Key Points:

German Bund 25.6 bps higher;

Italy 10-year 20.1 bps tighter;

Spain 10-year 10.3 bps wider;

Portugal 10-year 44.9 bps tighter;

Ireland 9-year 33.9 bps tighter;

Greece 10-year w.i. 33.4 bps tighter;

Banks rebound from last week’s sell-off;

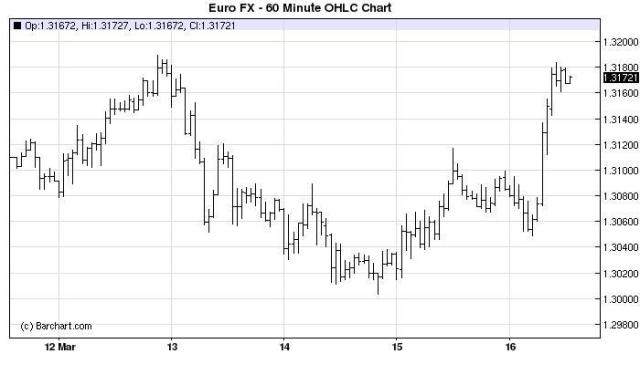

Euro/$ up 0.37%.

What's been said:

Discussions found on the web: