Source: Guggenheim Partners

Guggenheim Partners: It’s Time To Short The Treasury Market ‘Ponzi Scheme’:

In a recent letter, Scott Minerd of Guggenheim Partners argues that thanks to the world’s central banks, the economy — at least in the US — has entered a self-sustaining recovery, and that domestic investments will continue to do well. And like many other top tier investors (too many to count, really) he loathes Treasuries.

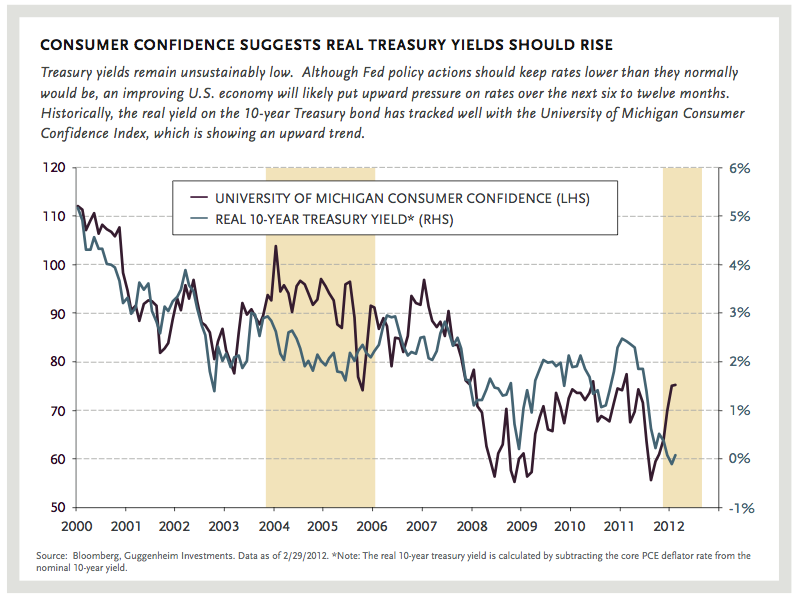

In the U.S. fixed income markets, the credit trade has worked very well. As concerns about the recession dissipate, riskier asset classes are rallying. However, while below investment- grade credits continue to look attractive, Treasury yields remain unsustainably low. I think the Fed’s policy actions will keep rates lower than they normally would be, but I believe the improving U.S. economy will put upward pressure on rates over the next six to twelve months. Essentially, what we have right now in the Treasury market is a Ponzi scheme. If the market had its way, Treasury rates would be at least 100 basis points higher than they are today. But because there is a buyer out there who is willing to keep purchasing these securities, even though it doesn’t make any economic sense as a prudent investment, the market has reached levels that wouldn’t be sustainable if free market forces were allowed to prevail.

Bianco Comment:

Larry Fink hates bonds. Warren Buffett hates bonds. Jeremy Siegel has hated bonds since George Bush Sr. was in office (1994). Nassim Taleb thinks every human on the planet should be short bonds. Leon Cooperman wouldn’t be caught dead owning bonds. 99% of economists are bearish on bonds. Now Guggenheim chimes in on hating bonds as if we have never heard this before.

The problem is that we have heard it over and over and for nearly a decade. And, for nearly a decade, this call has been dead wrong. The long bond has had a 34% total return in the last 12 months versus a 5.1% return for the S&P 500 over the same period. The bond market has also outperformed stocks over the last 30 years for the first time since the Civil War.

At some point the bond bears are going to be right. But after a decade of crying wolf, it is hard to listen to these calls.

What's been said:

Discussions found on the web: