Many people seems to be crediting the market’s resilience to factors such as end of the month/quarter window dressing.

I remain unconvinced.

There has been a solid bid under this markets since October, goosed every time Ben Bernanke thinks about any form of liquidity. If he so much as eases himself into a hot bath, the market shoots higher.

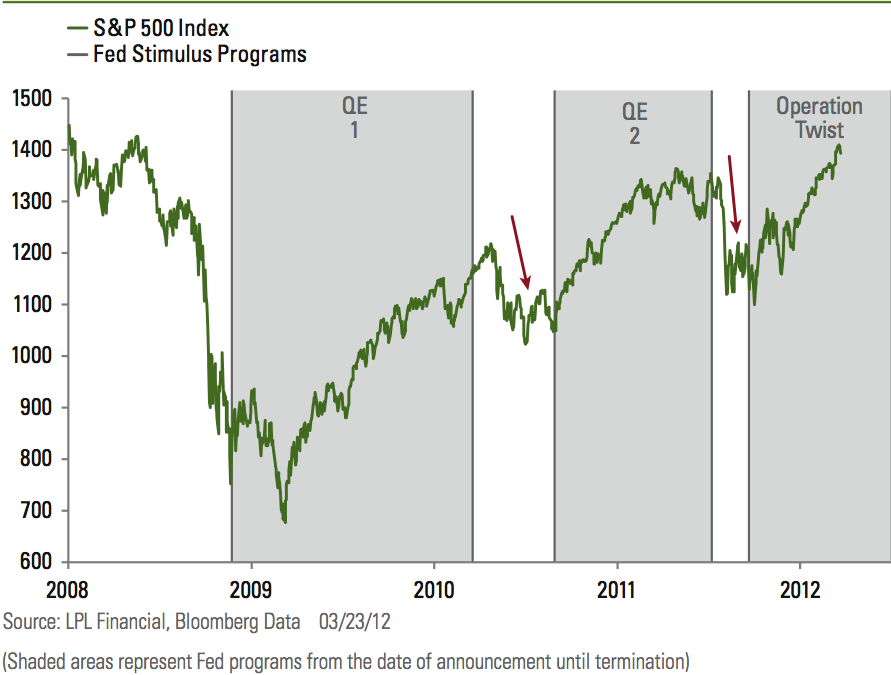

The chart below is a variant of something we have shown repeatedly. It is the SPX overlaid with each of the Fed Quantitative operations. The latter phase of this Bull market clearly reflects the Fed’s impact on equity prices.

Let’s start with 2009: In March of that year, I saw the conditions in place for a bottom. However, I was not clued into just how significant the Fed’s role was going to be a year later. I credit (former bond guy and now all around strategist) James Bianco for making me understand in September 2010 just how influential — nay, dominant — the Fed was going to be with QE2. When we saw the same circumstances in October 2011 — August selloff, fear of double dip recession — we just knew the next Fed program was imminent. Operation Twist was launched about 25% SPX ago. Now, markets are running up in anticipation of the third movie in the Fed trilogy, QE3.

I keep telling hedge fund buddies its not their job to be policy wonks. My job is to assess the seas, winds and tides, and sail into the right direction. That’s the role of any asset manager.

However, I cannot help but wonder if Bernanke hasn’t painted himself into the same corner that Greenspan did. The traders on the street — essentially 2-year olds with fast computers that slosh around billions in assets — know exactly how to throw a hissy fit. They are happy to whack the market 20% to get Ben’s attention, and he seems happy to give them their binky to make them stop crying and go back to their cribs.

The Fed and Wall Street have evolved into a dysfunctional relationship, and the most powerful central bank in the world seems to not know significantly the power in its most significant relationship has shifted.

The Fed has been %#$$y-whipped by a bunch of tantrum throwing 28 year old traders. In order to tighten monetary policies to some semblance of normalcy is going to take a number of things going just right. I hope they can accomplish this; I suspect to do so is going to require a combination of extraordinary skills and stupendous luck.

>

Another Fed Stimulus Program Ending Soon ?

click for larger chart

>

Source:

10 Indicators to Watch for Another Spring Slide

Jeffrey Kleintop

LPL Financial March 26, 2012

http://lplfinancial.lpl.com/Documents/ResearchPublications/Weekly_Market_Commentary.pdf

What's been said:

Discussions found on the web: