My morning reading material:

• Low Growth in Earnings Is Expected (NYT)

• The 401(k): Americans ‘just not prepared’ to manage their own retirement funds (Washington Post) see also How America Spends Money: 100 Years in the Life of the Family Budget (The Atlantic)

• Jamie Dimon’s 38 page Letter (JPM) or just read Highlights (WSJ)

• Don’t Look to the Market for Advice (Institutional Investor)

• HBS Survey on U.S. Competitiveness (Harvard Business School)

• Conference: Innovative Data Sources for Regional Economic Analysis (George Washington Institute of Public Policy)

• Welcome to Ikea-land: Furniture giant begins urban planning project (The Globe and Mail)

• Antarctic ice shelf shrunk by 85 percent since 1995 (The Raw Story)

• Obama’s Game Plan: Let’s Make This All About the Republicans (New Yorker)

• Tax Haven Crackdown Creates Opportunities for Bankers (DealBook)

What are you reading?

>

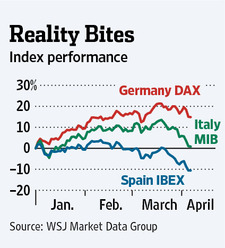

Euro Zone Heading for Another Hot Summer

Source: WSJ

What's been said:

Discussions found on the web: