My morning reading material:

• Gasoline Futures Tumble As Oil-Supply Fears Ebb (WSJ)

• Earth to Ben Bernanke (NYT) see also I repeat: The Fed’s Permanent Zero rate policy is toxic (Credit Writedowns)

• A reality check for Facebook investors (Market Watch)

• The Top 1% Saw Their Incomes Rise 8 Times,1979-2007 (Forbes) see also You Don’t Need This “Recovery” (Harvard Business Review)

• Housing Notches Tiny Gains (WSJ)

• Thinking in a Foreign Language Makes Decisions More Rational (Wired)

• Reports of Medicare’s death are greatly exaggerated (Washington Post) see also Want to cut health care costs? Start here. (Washington Post)

• Why Jon Huntsman is leaving the GOP (not because they’re Communists) (Yahoo News)

• Did exploding stars help life on Earth to thrive? (Royal Astronomical Society)

• Today’s WTF toy! The iPhone Lens Dial (Photo Jojo)

What are you reading?

>

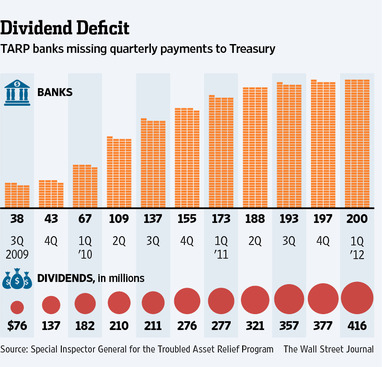

TARP: Billions in Loans in Doubt

Source: WSJ

What's been said:

Discussions found on the web: