My early morning reads:

• Chips Forecast a Slowdown Is Coming (WSJ) see also History Stole Your Market Returns (Motley Fool)

• Don’t ask Bank of America: What Do I Owe You? (Columbia Journalism Review)

• Byron Wien: The Disbelievers (Blackstone) see also 2007-09 bear market now totally erased (Market Watch)

• Wave 5 Of The Cyclical Bull Market (Adisor Perspectives)

• Signs of a New Tiananmen in China (Diplomat)

• Opportunities for the contrarians (Financial Post)

• SEC Probes Ties to High-Speed Traders (WSJ) see also Regulators Finalize Oversight Process for Nonbanks (WSJ)

• US draws up plans for nuclear drones (Guardian)

• Self-sculpting sand (MIT News)

• This is what your Universe looks like! (Science Blogs) see also ‘Super-Earths’ in M-Dwarf Survey: Life on Other Planets? (Yahoo News)

What are you reading?

>

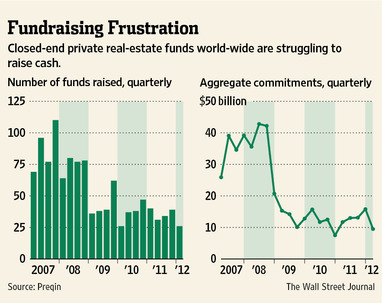

Short of New Funds, Firm Takes a ‘Pause’

Source: WSJ

What's been said:

Discussions found on the web: