My airplane reading for today:

• ‘Fortune 500′ of 1812 Shows U.S. Banks’ Early Influence (Bloomberg)

• Are speculators behind high oil and gasoline prices? (McClatchy)

• The inevitability of shadowy banking (and how to regulate it) (Alphaville) see also Profit Drop at U.S. Banks Imperils Rally (Bloomberg)

• Top Concerns From Regulatory Compliance Associates: Pay-to-Play, Form PF, Social Media (Advisor One)

• How Instagram founder Kevin Systrom became insta-rich (LA Times) see also Facebook Plays Offense and Defense in a Single Deal (NYT)

• Anti-Theft Effort May Boost iPhone Resales (SmartMoney)

• Microsoft quietly buys Netscape browser technology (Slash Gear)

• Google’s Washington Night (NYT)

• A Start-Up Rethinks the Process of Getting a Trademark (NYT)

• Future TechStars, Step Forward (Inc.)

What are you reading?

>

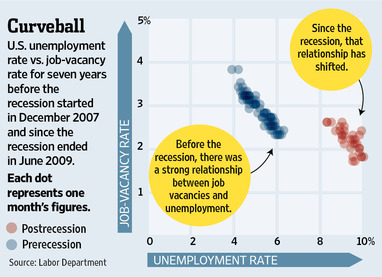

On Jobs, No Time for a Celebratory Beveridge

Source: WSJ

What's been said:

Discussions found on the web: