On the weekend, I like to reference some of the longer, broader items that have caught my eye. Without the trading day interrupting us, we can take some additional time to delve deeper intoa broader variety of related subjects.

• Incremental Change Wins Apple Big Gains (TidBITS)

• Advisor: The Truth About Ric Edelman (Financial Advisor)

• The New American Dream: Renting (Circa 2009) (WSJ)

• Facebook’s Sheryl Sandberg has a talent for making friends (LA Times)

• Nassim Taleb’s Book Recommendations (Farnam Street)

• China: The Revenge of Wen Jiabao (Foreign Policy)

• Intoxicating Trends: Attitudes to drugs have been in constant flux owing as much to fashion as to science. (History Today)

• A Death in Yellowstone: What Happens to Bears That Attack Humans? (Slate)

• The neuroscience of Bob Dylan’s genius (The Guardian)

• Photographer Nan Goldin’s best shots (Guardian) see also Britain from above: Jason Hawke’s aerial photographs of cities at night (Telegraph)

Whats on your tablet?

>

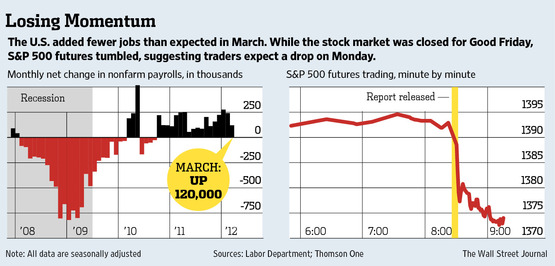

U.S. Labor Market Slows Its Stride

Source: WSJ

What's been said:

Discussions found on the web: