My morning reading material, edited in real time (done):

• Inspect the Fees in Your 401(k) (WSJ) see also Americans ‘just not prepared’ to manage their own retirement funds (Washington Post)

• Special focus: The Changing Face of Big Money (DealBook)

• JPMorgan illegally let Lehman Bros. count customers’ funds as its own (Washington Post) see also JPMorgan’s practices bring scrutiny (FT)

• Bankers Form SuperPac for ‘Surgical’ Strike at Industry’s Enemies (American Banker)

• Americans brace for next foreclosure wave (Reuters)

• Why the Fed has taken QE3 off the agenda (FT.com) see also The Case Against Fiat Money (WSJ)

• Ex-Con Man Says JOBS Law Makes Guys Like Him Rich (Bloomberg)

• Apple’s iPad tops Consumer Reports’ list despite heat issue (Reuters) see also Project Glass (Google+)

• China’s Bloody Factories: A Problem Bigger than Foxconn (Pulitzer Center)

• Now this gets interesting: Anonymous hacks hundreds of Chinese government sites (ZDNet)

What are you reading?

>

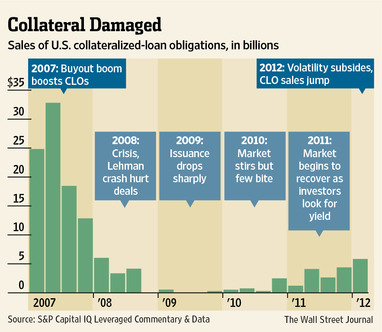

Market Chilled by Crisis Sees a Thaw

Source: WSJ

What's been said:

Discussions found on the web: