My early morning reads:

• In the picture: a short history of nationalisations (FT) see also Nationalization in Argentina: We’ve seen this movie before (Setty’s Notebook)

• Volcker Rule Gets Murky Treatment (DealBook)

• Are you confused About Stocks? You are not alone. (A Dash of Insight)

• A Day In The Life: Investment Banking Associate (Businessweek) Gets up at — WTF? — 7:00 am?!?

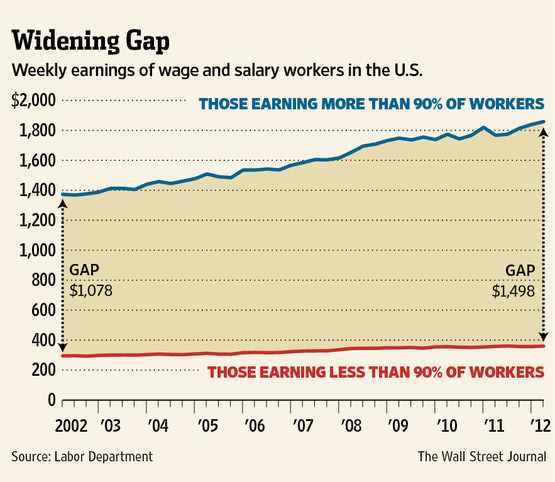

• Looking at pay scales:

…..-Workers’ Pay Divide Persists (WSJ)

…..-Income of Rulers vs. the Ruled (Economix)

• Forecasting the Great Recession: DSGE vs. Blue Chip (Fed New York)

• That’s Governor Zhou to you (Alphaville)

• Bank of America Faces Bad Home-Equity Loans: Mortgages (Bloomberg)

• The Lost Steve Jobs Tapes (Fast Company)

• John Cleese on the 5 Factors to Make Your Life More Creative (Brain Pickings)

What are you reading?

>

Workers’ Pay Divide Persists $$

Source: WSJ

What's been said:

Discussions found on the web: