My morning reading material:

• Bernanke Takes On Krugman’s Criticism Ignoring Own Advice (Bloomberg) see also Lonesome Dove (Economist)

• Cyclical $Bull in a Secular Bear (Stock Trader’s Almanac)

• Can Silicon Valley fix the mortgage market? (Reuters)

• What Was the Very First Hedge Fund? Ask Warren Buffett (Bloomberg)

• Banks are on a eurozone knife-edge (FT.com) see also Double-Dip Recession in Britain (NYT)

• Obama’s Oil Blindness (Slate)

• The Boys Who Cried Fox: Why some conservatives are bashing Fox News about BIAS (NYT)

• What Your Klout Score Really Means (Wired)

• What if Facebook isn’t so special after all? (Gigaom)

• Jethro Tull gets thicker on “Brick 2” (Yahoo News)

WhatTF are you reading ?

>

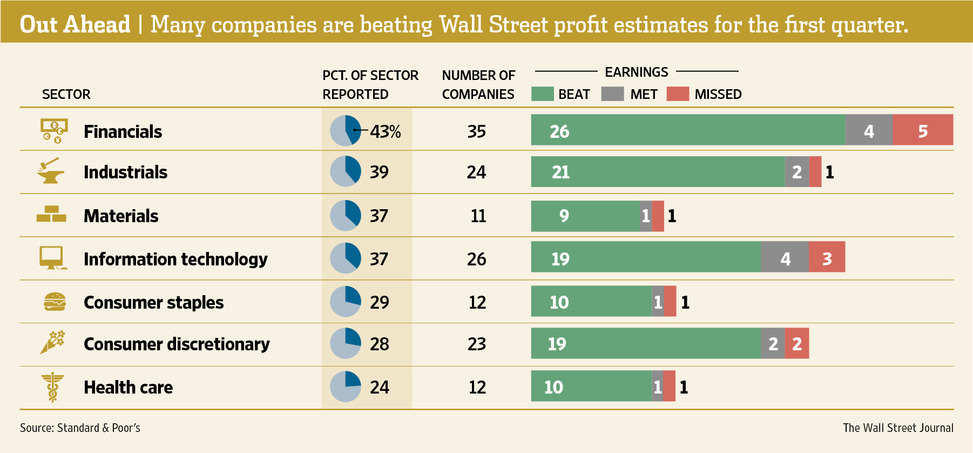

Manufacturers Regain Swagger With Rosy Earnings

Source: WSJ

What's been said:

Discussions found on the web: