My train reading for this afternoon

• Stocks Are Cheap vs Bonds? Logic Says Otherwise (Smart Money)

• Baum: Geithner Takes Lead in BLS ‘Much Ado About Nothing’ (Bloomberg)

• Real Tax Rates of the Rich (Wealth Report)

• Anat Admati: More Bank Equity Is Needed (Institutional Investor) see also BofA Faces Bad Home-Equity Loans: (Bloomberg)

• Louisiana sues banks for RICO, Wire Fraud Racketeering due to MERS (mattweidnerlaw)

• Duncan: Capitalism is dead, credit new king (Marketwatch)

• Pulitzer winner on Taxes: But Nobody Pays That (NYT)

• MBS Discovery Battles Heating Up, Impacting Litigation Timelines and Leverage (Subprime Shakeout) see also Why Entrepreneurs Should NOT Buy Homes (Tech Crunch)

• It’s Time to Upgrade Your Biological Software (Think Big)

• LOL Chris Christie Denies Falling Asleep at Springsteen Show (Bloomberg)

What are you reading?

>

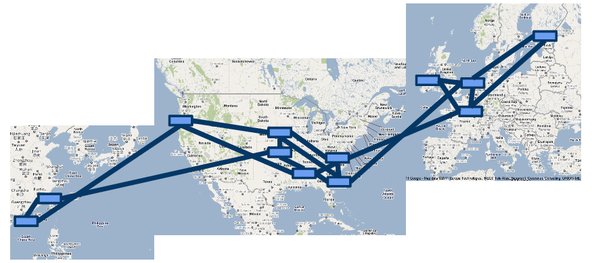

Google Opens Up About Its Network

Source: Bits

What's been said:

Discussions found on the web: