My morning reading material:

• Five Years After Crisis, No Normal Recovery (Bloomberg) see also State of the World Economy: The Emperor Has No Clothes (Triple Pundit)

• In Defense of Short Selling (The Street)

• Why People Hate the Banks (NYT) see also Is Foreclosure Abuse the Biggest Problem in the Housing Sector? (Institutional Risk Analyst)

• Michael Mauboussin: Shaking the Foundation: Revisiting Basic Assumptions about Risk, Reward, and Optimal Portfolios (Legg Mason Capital Management)

• The Q Ratio and Market Valuation (Advisor Perspectives)

• The Big Split: Why the hedge fund world loved Obama in 2008—and viscerally despises him today (New Republic) see also Why London, New York Draw the Wealthy (Barrons)

• Worst US Earnings Growth Since 2009 Seen As Stocks Near Highs (Nasdaq)

• Groupon looking like Pets.com of current tech boom (Market Watch)

• Kurt Vonnegut: I Am Very Real (Letters Of Note)

• In Manhattan Pizza War, Price of Slice Keeps Dropping (NYT)

What are you reading?

>

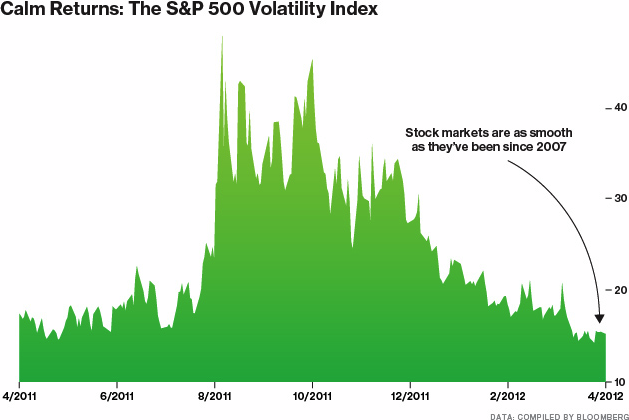

Source: Businessweek

What's been said:

Discussions found on the web: