My morning reading material:

• NYAG: The Man the Banks Fear Most (American Prospect)

• Apple and the myth of “The Law of Large Numbers” (NetworkWorld)

• China’s Biggest Banks Are Squeezed for Capital (DealBook)

• ‘Tainted,’ but Still Serving on Corporate Boards (DealBook)

• Rentals Gone Wild (Naked Capitalism) see also Housing Sector – Why the Fed Depicts it as “Depressed” (Northern Trust)

• The Creative Monopoly (NYT)

• Euro crisis is not over. Just how surprised should you be? (Also Sprach Analyst)

• How the Media Has Shaped the Social Security Debate (Columbia Journalism Review) see also Social Security Fund to Run Out in 2035, Trustees Say (Bloomberg)

• Why Mitt Romney Won’t Take GOP Down Another VP Rabbit Hole (TPM)

• Rosen’s Trust Puzzler: What Explains Falling Confidence in the Press? (Press Think)

What are you reading?

>

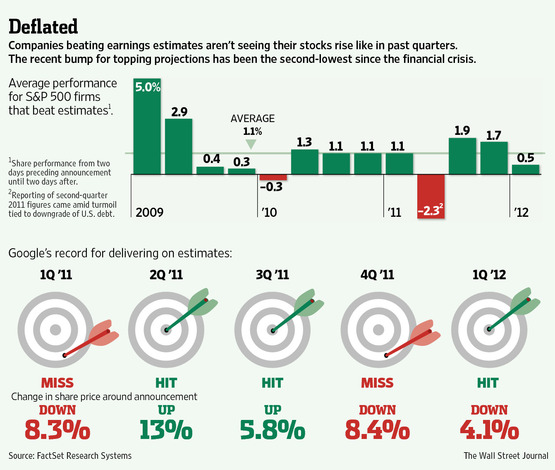

‘Beats’ Get the Brush-Off

Source: WSJ

What's been said:

Discussions found on the web: