My afternoon train reading:

• S&P 500 Beating Gold Most Since 1999 on Positive Earnings (Bloomberg)

• A Paradox: Avoid Correlation by Following the Trends (All About Alpha)

• Investors Are Looking to Buy Homes by the Thousands (NYT) see also Manhattan Apartment Prices Decline (Bloomberg)

• The God of Gamblers: Why Casinos Are Moving to Macau (New Yorker)

• ‘Apple Fever’ Prompts Predictions of $1 Trillion Value (Bloomberg) see also Apple and the Return of the Gimmicky Price Targets (TRB)

• Pensions Find Riskier Funds Fail to Pay Off (NYT)

• No Deal: Why you shouldn’t believe the theory behind Groupon’s business model (Slate) see also Why Groupon is poised for collapse (Venture Beat)

• How China Steals Our Secrets (NYT)

• Nobel Winner Eric Kandel: ‘The Age of Insight,’ Memory, the Holocaust, and the Art of Vienna (The Daily Beast)

What are you reading ?

>

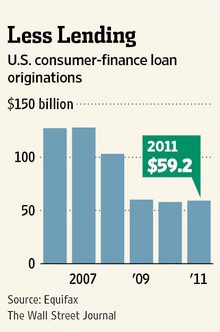

Choices Shrink for Subprime Set

Source: WSJ

What's been said:

Discussions found on the web: