My afternoon train reading:

• S&P 500 Caps Longest Decline Since November on Europe (Bloomberg) see also European Bank Shares Take a Nosedive (Dealbook)

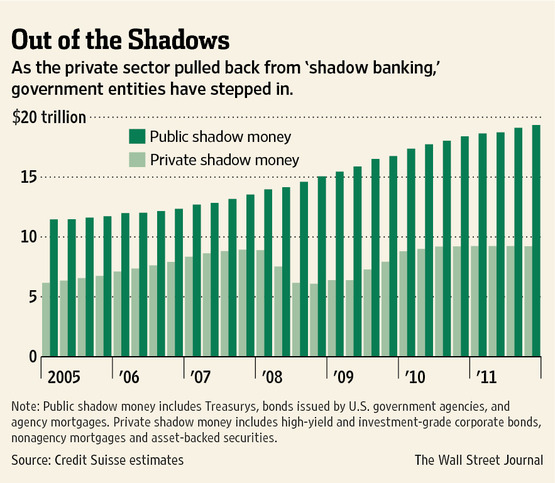

• The Age of the Shadow Bank Run (NYT)

• Here is why Facebook bought Instagram (Gigaom) see also Visual Candy: The Rise of Instagram (New Yorker)

• Bankruptcy costs and America’s household debt crisis (VOX)

• How to Really Simplify the Tax Code (Economix) see also The U.S. Has a Low Corporate Tax (Citizen for Tax Justice)

• Jonah Lehrer on Decision-Making (The Browser)

• 50 Content Ideas to Create Buzz (Conversation Agent)

• Album review: The Alabama Shakes’ ‘Boys & Girls’ (LA Times)

• Rick Santorum drops out of the presidential race (WaPo) see also Barack Obama’s empathy edge (Washington Post)

• For Your Ads Only: 50 Years of James Bond Product Placement (Businessweek)

What are you reading?

>

Time to Cast More Light on Finance’s ‘Shadows’

Source: WSJ

What's been said:

Discussions found on the web: