My train reading for this afternoon

• iPad Onslaught Sends Taiwanese Laptop Makers to the Cloud (Bloomberg)

• Cost of Spain’s Housing Bust Could Force a Bailout (NYT)

• Are You a Right Brain or Left Brain Investor? (Forbes)

• Dreaded IPO-crash signal flashes bear warnings (Market Watch)

• Android Is Suddenly In A Lot Of Trouble (Business Insider) see also Microsoft’s Mobile Comeback Is Looking Terrible (Read Write Web)

• IT’S OFFICIAL: Keynes Was Right (Yahoo Finance)

• Sallie Krawcheck: Don’t blame me (Market Watch)

• 10 Things Open Houses Won’t Tell You (SmartMoney) see also Three hidden costs of the foreclosure crisis (Market Watch)

• Kicking the can down the road: No End in Sight (New Yorker) see also Neither Real, nor Business, nor Cycles (Noahpinion Blog)

• The elephant on the court (Economist)

What Are you Reading?

>

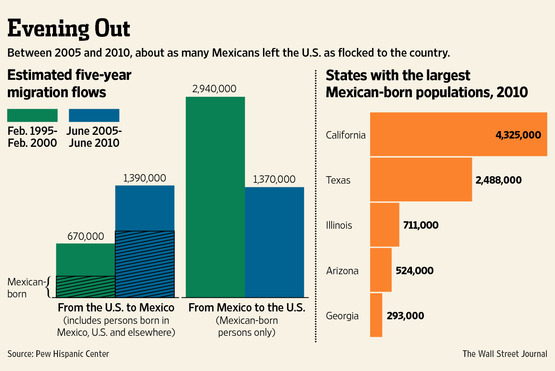

Tide Turns on Border Crossing

Source: WSJ

What's been said:

Discussions found on the web: