Via Demonocracy, we see this basic take on derivatives:

A derivative is a legal bet (contract) that derives its value from another asset, such as the future or current value of oil, government bonds or anything else. Ex- A derivative buys you the option (but not obligation) to buy oil in 6 months for today’s price/any agreed price, hoping that oil will cost more in future. (I’ll bet you it’ll cost more in 6 months). Derivative can also be used as insurance, betting that a loan will or won’t default before a given date. So its a big betting system, like a Casino, but instead of betting on cards and roulette, you bet on future values and performance of practically anything that holds value. The system is not regulated what-so-ever, and you can buy a derivative on an existing derivative.”

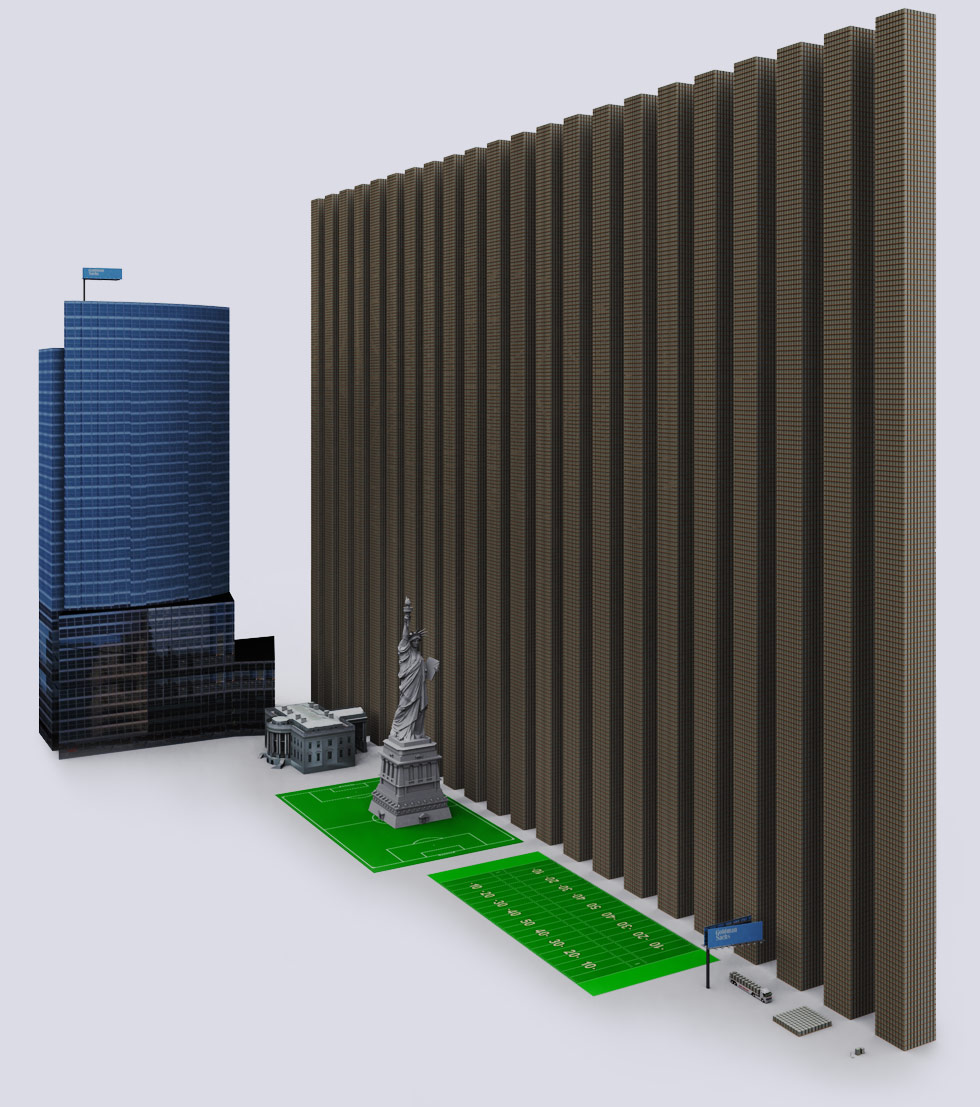

Where things go mad is when we start to conceptualize the amount of exposure the major banks (and through them you the taxpayer) have. The scale of derivatives these days has becomes so immense as to be nearly unimaginable.

So Demonocracy helps us along with this giant infographic of the 9 biggest banks by their Derivative exposure, both individually and collectively.

Here for example is State Street Bank — note the $1.39 trillion dollar pile of derivatives next to their HQ — as well as Goldman Sachs and their $44.2 trillion dollar derivative pile:

>

click for giant graphic of largest banks and their derivative exposure

>

Compare that with Goldman Sachs

What's been said:

Discussions found on the web: