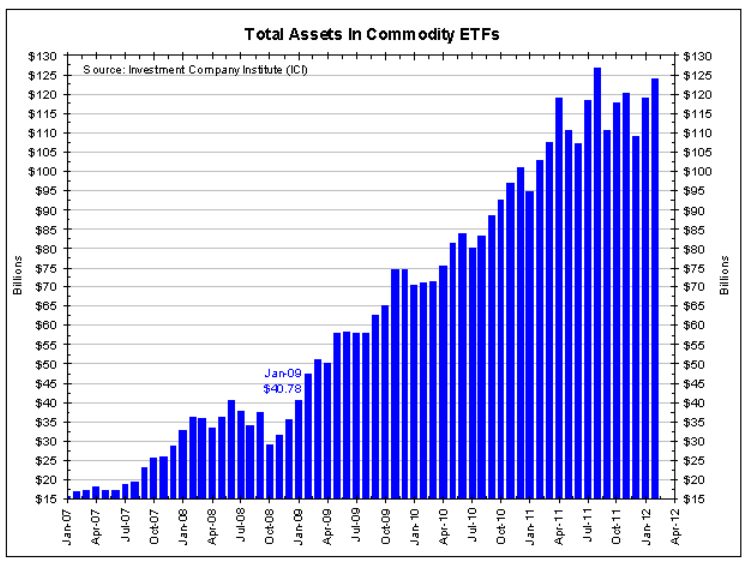

Click to enlarge:

˜˜˜

˜˜˜

Yahoo Finance – ETF Assets Slowly Gaining on Mutual Funds

While the $10 trillion U.S. mutual fund market dwarfs the $1.1 trillion exchange traded fund industry, inflows into ETF products have been consistently positive, whereas mutual funds inflows are sputtering. U.S. listed ETF inflows are at a consistent $118 billion per year, according to a Center for Due Diligence research note. U.S. equity ETFs drew in $85 billion in net inflows in the the three years up to the end of 2011, compared to the $200 billion in outflows experienced in equity mutual funds. Fixed-income ETFs also saw notable inflows of $121 billion over the same period. Additionally, the growing class of “specialty” or niche strategy products is also just getting off its feet, garnering $653 million in assets over the past three years.BlackRock’s iShares , State Street Global Advisors and Vanguard are the three largest ETF providers, in that order. However, Vanguard has been attracting greater inflows over the past two years, which suggests that the company’s low-cost products are enticing more investors.

Source: Bianco Research

What's been said:

Discussions found on the web: