>

Let’s not mince words: Yesterday’s market action — down 1.75% on heavier volume — was a shellacking:

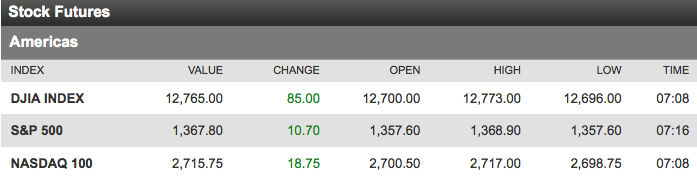

DJIA 12715.93 -213.66 -1.65%

Nasdaq 2991.22 -55.86 -1.83%

S&P 500 1358.59 -23.61 -1.71%

We are now rather oversold, and are due for a bounce. What I want to look at is the quality of the market internals during this period. It will provide some insight into how far we could bounce back, and where support might be if and when this reaction rally (2-7 days) fails.

I find whenever I discuss these sorts of technical actions, people get confused by the apparently conflicting perspectives (“You sound bearish today and bullish yesterday“). The key to understanding these are your holding periods and timelines. The wiggles in the day-to-day action mean different things to traders, investors, and company insiders.

My holding period is typically measured in quarters and years. But I feel compelled to be aware of what takes place over weeks and months. Shorter time periods than that — hours and days — are so noisy as to be meaningless to me.

Sometimes it appears market participants are disagreeing when they are really just looking at different holding periods.

Investors should never try to “play the squiggles” — using long term valuation measures to trade in and out for a quick profit rarely works. I’ve seen many a good investment turned into a trade — dumped on initial strength shortly after establishing the position for the quick winner, only to watch it run away over the next year. Its usually accompanied by this hackneyed phrase: “No one ever went broke taking a profit.”

Actually, they do. You need big winners to offset a lot of little losers, and small winners don’t help. Its like snatching defeat from the jaws of victory.

Traders who allow a short term position to turn into an investment are usually doing so because they got caught leaning the wrong way and are refusing to admit their error. Rather than take a small hit, they nurture their losing position on the hopes of it recovering. That happens rarely, but far more often the bad trade turns into a giant loss. In some cases, it becomes a blow out disaster that ends the trader’s career.

Any trader that wants to let a winning trade can and should do so, but they must establish a new exit rule for that position. I never like to give back more than 25% of a gain in these circumstances. You can alternatively use a shorter moving average as your exit signal.

My rules:

1. Make sure you understand what your holding period is before you establish any position.

2. Traders should NEVER let any losing trade turn into an investment.

3. Strong investments should be given the benefit of the doubt, rather than taking the quick profit.

4. Winning trades should be allowed to run, but require a new exit strategy.

These are fairly basic but oft overlooked ideas. Understand them or create your own, but please don’t just wing it. That’s a real formula for disaster.

>

Previously:

Expect to Be Wrong in the Stock Market (The Street.com)

What's been said:

Discussions found on the web: