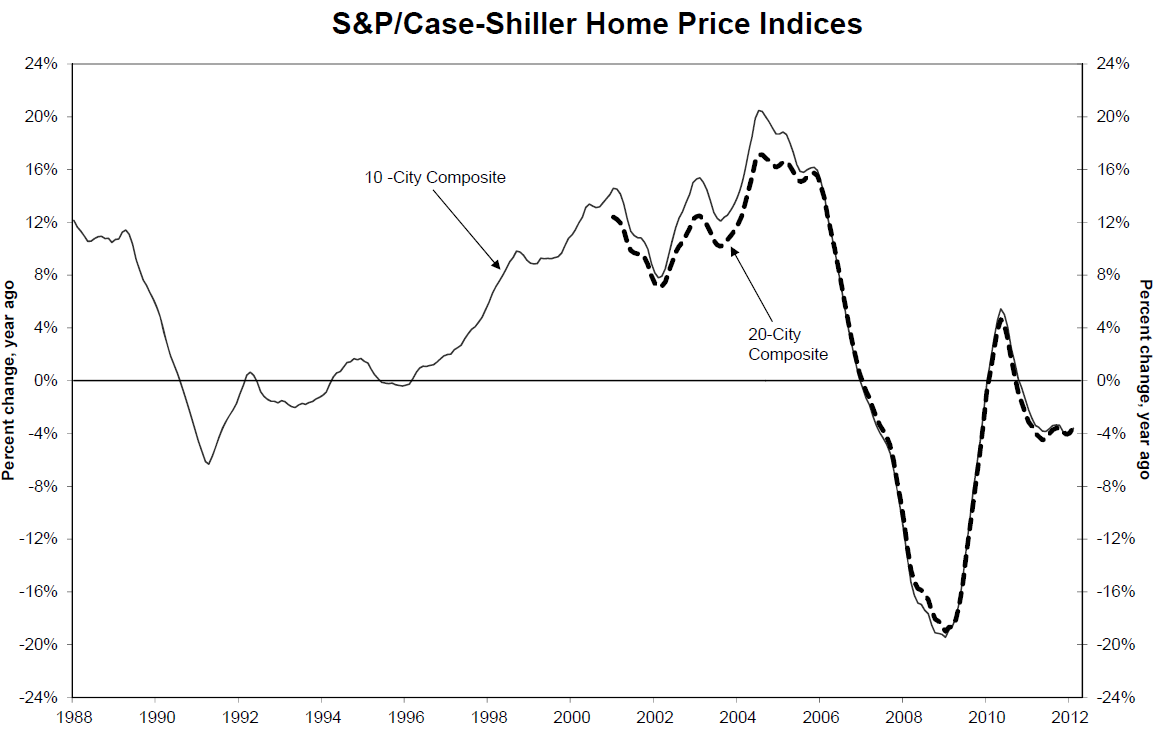

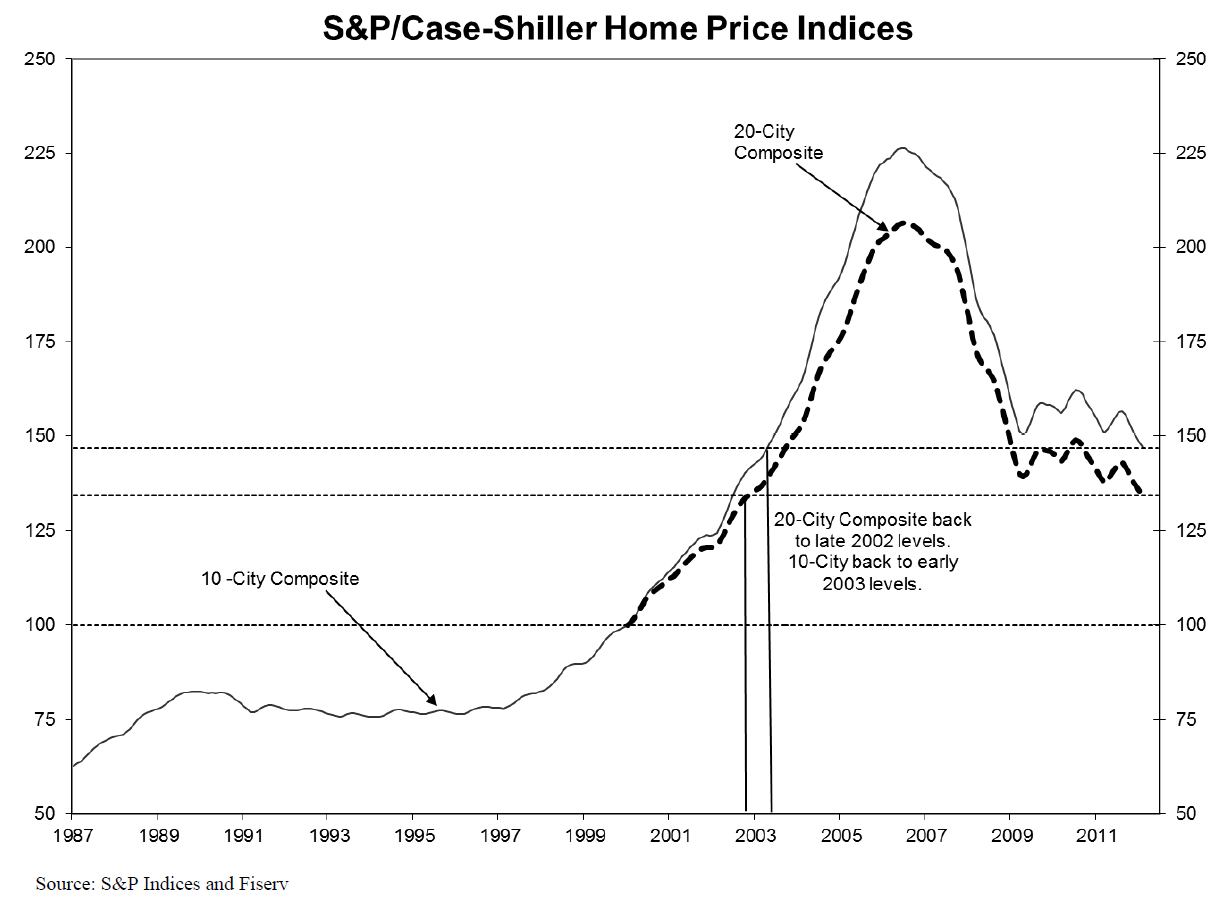

Case Shiller Home Price Indices for February 2012, showed annual declines of 3.6% and 3.5% for the 10- and 20-City Composites, respectively. This is an improvement over the annual rates posted for the month of January, -4.1% and -3.9%, respectively.

>

˜˜˜

Source:

S&P Indices

Press Release

New York, April 24, 2012

What's been said:

Discussions found on the web: