~~~

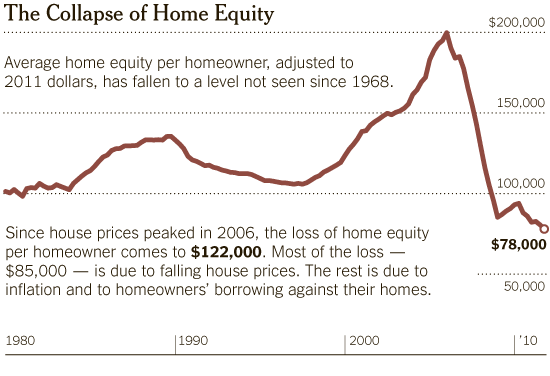

No need to even excerpt the text — the charts tell the entire story . .

>

Source:

Still Crawling Out of a Very Deep Hole

TERESA TRITCH

NYT, April 7, 2012

http://www.nytimes.com/2012/04/08/opinion/sunday/still-crawling-out-of-a-very-deep-hole.html

What's been said:

Discussions found on the web: