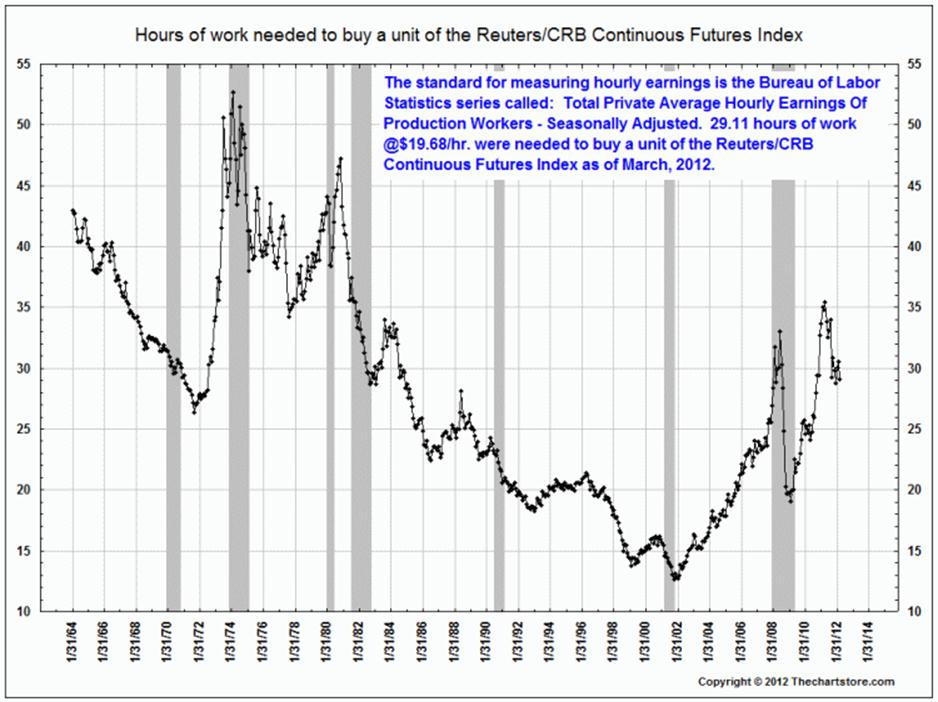

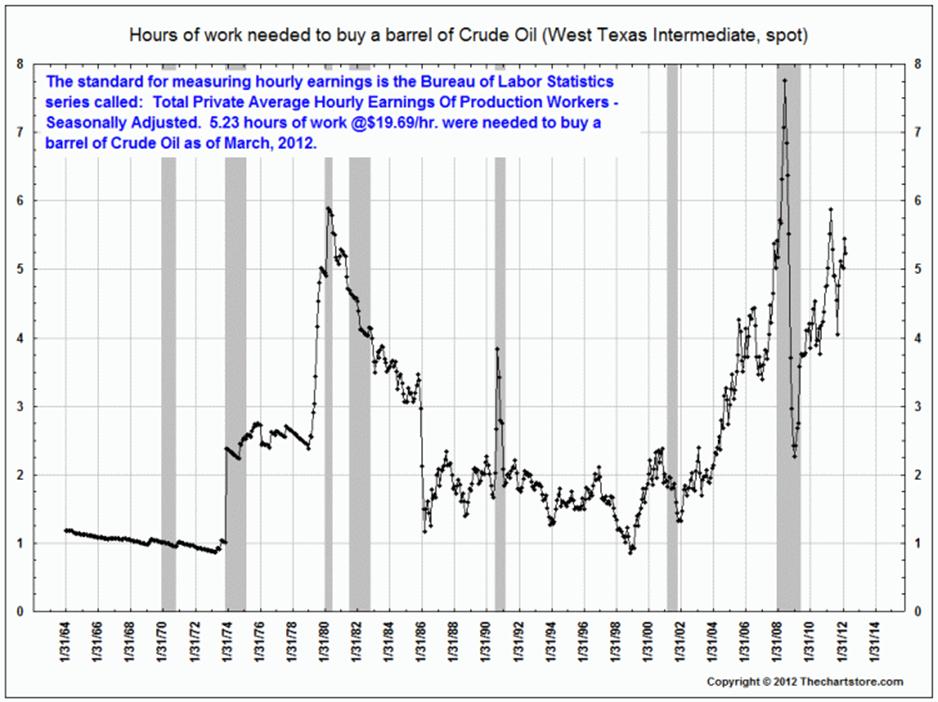

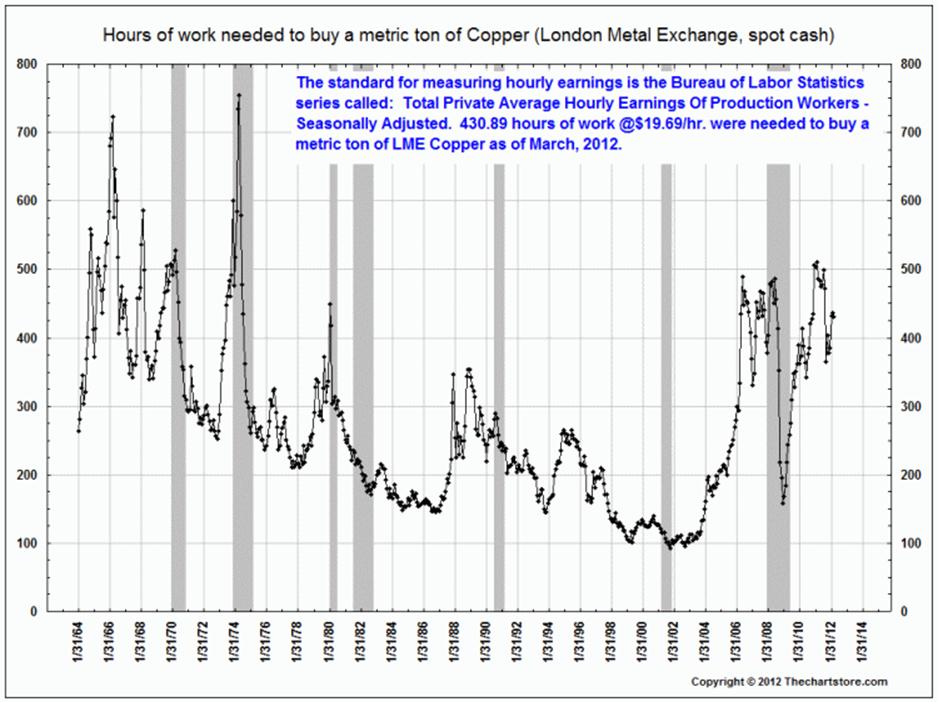

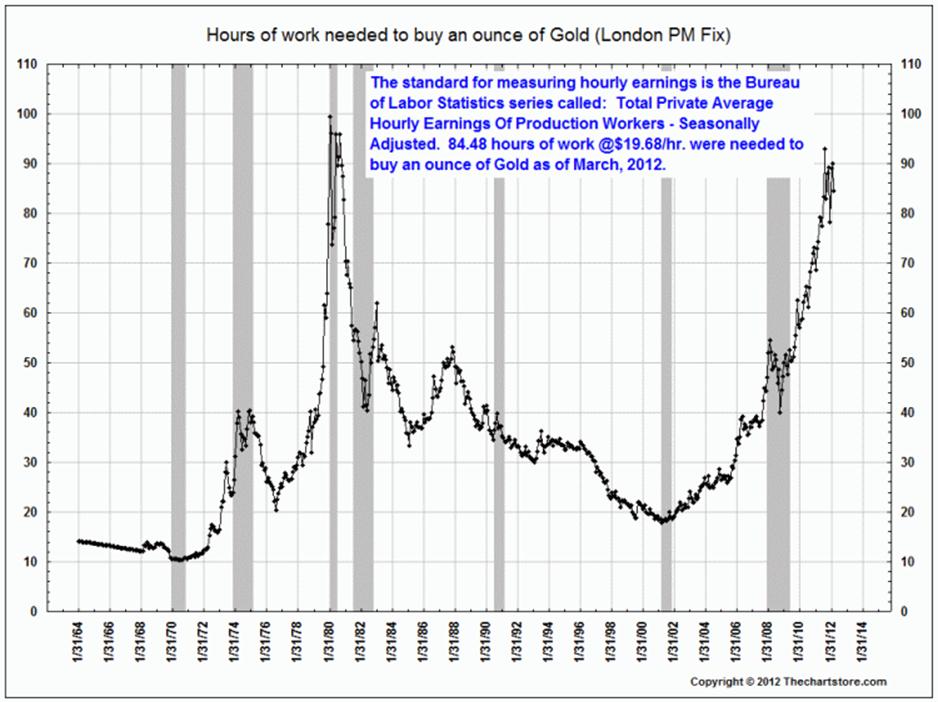

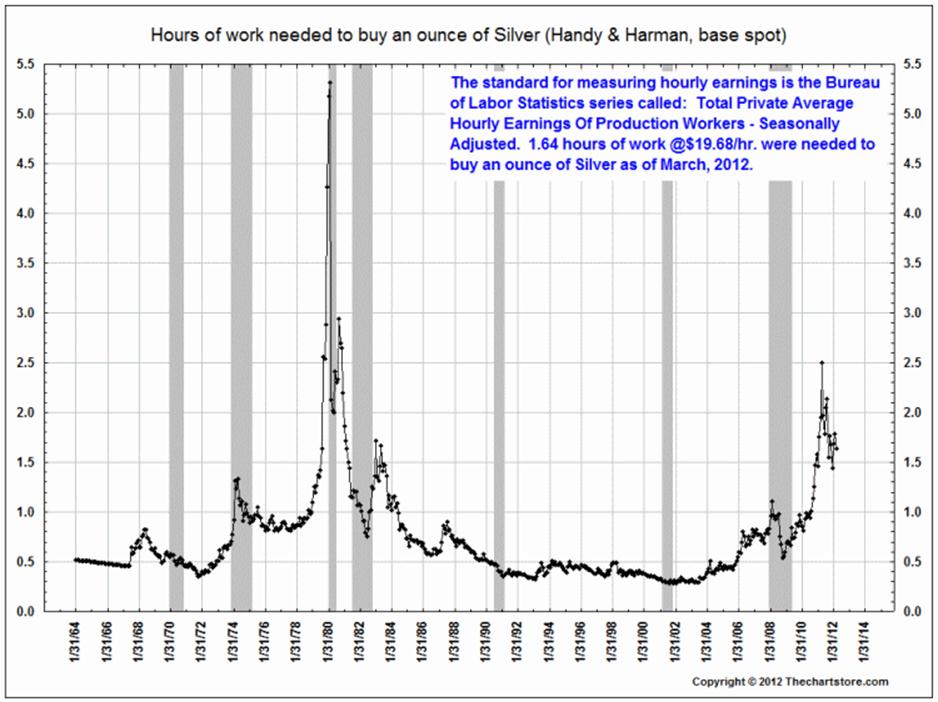

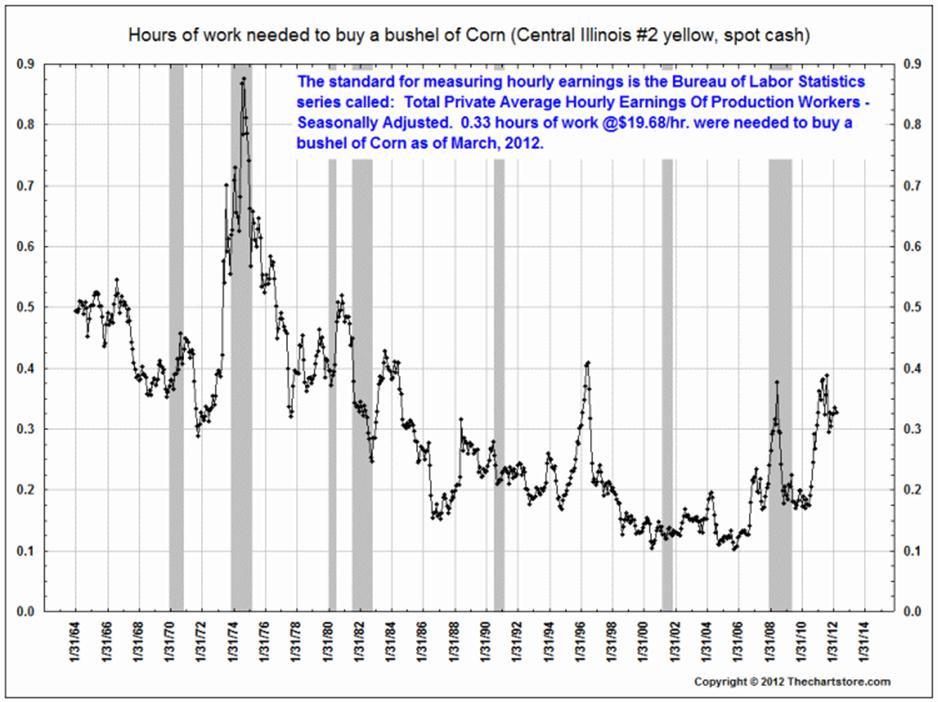

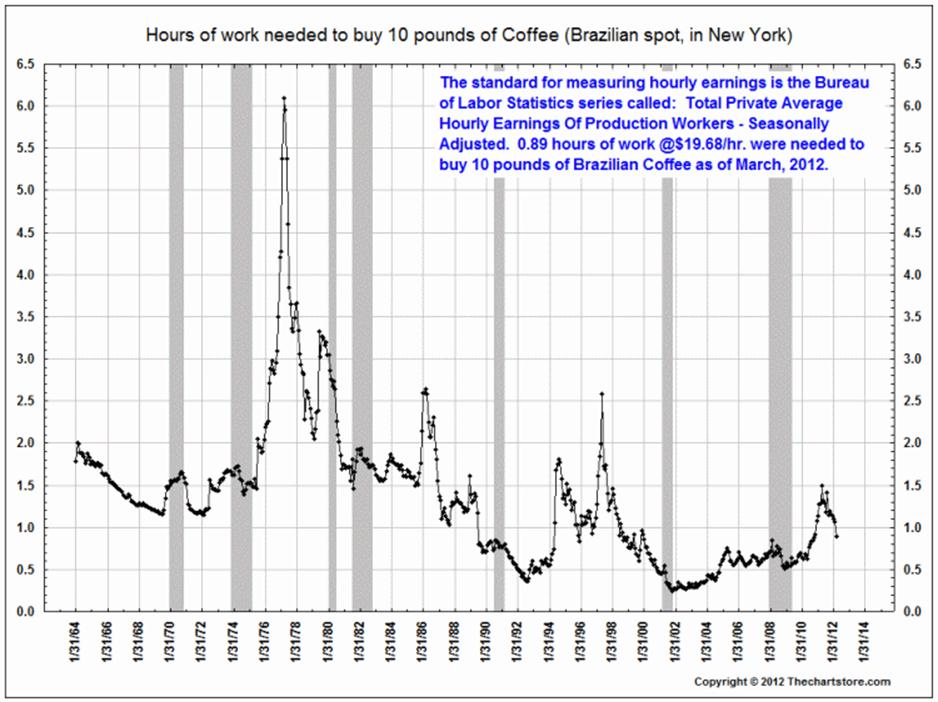

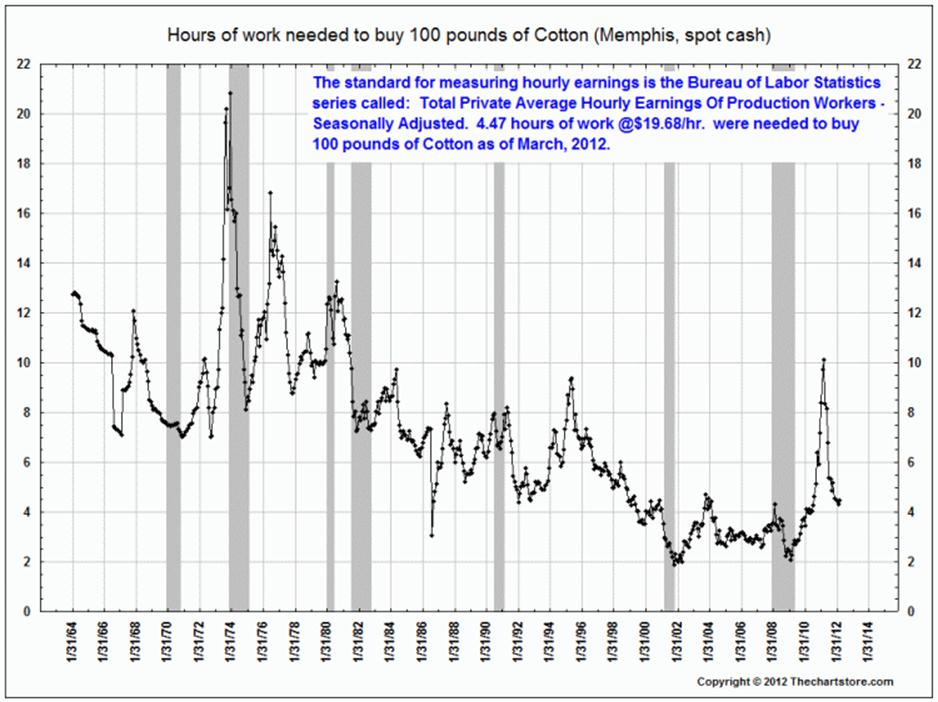

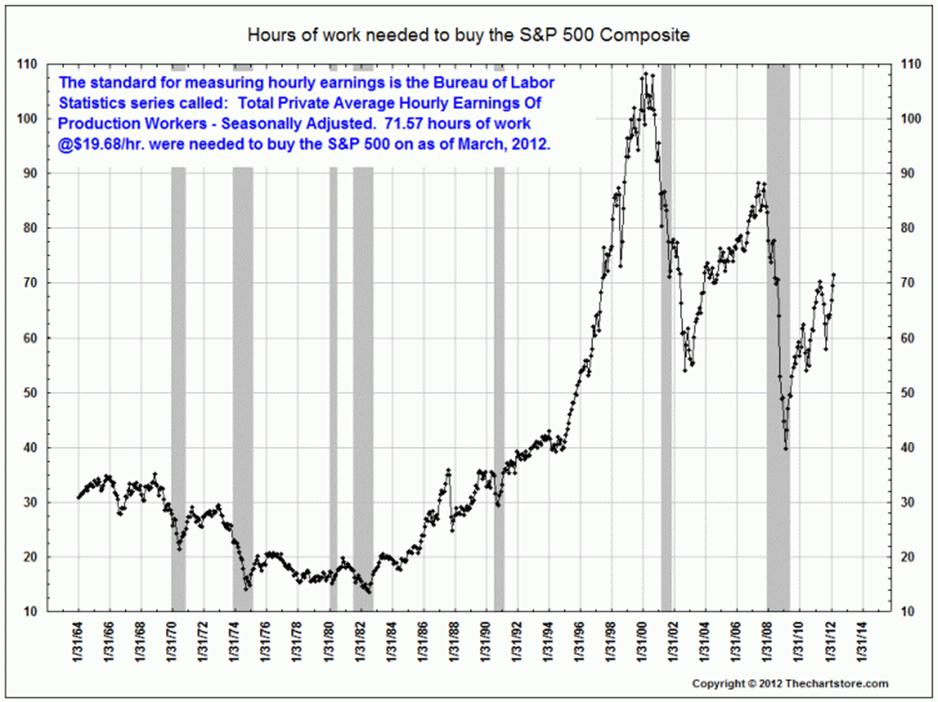

From Ron Griess and the always fascinating Chart Store, we see a very different read of inflation.

He shares this awesome selection from his weekly blog (subscription only) of commodities, crude oil, copper, gold, silver, corn, coffee, cotton, and the S&P500 — all priced in terms of hourly earnings:

>

˜˜˜

˜˜˜

˜˜˜

˜˜˜

˜˜˜

˜˜˜

˜˜˜

˜˜˜

What's been said:

Discussions found on the web: