The third installment in the very insightful and popular NYT iEconomy series is front page of the Sunday NYT.

Part 1: An Empire Built Abroad: How the U.S. Lost Out on iPhone Work

Part 2: A Punishing System: In China, Human Costs Are Built Into an iPad

Part 3: Protecting Profits: How Apple Sidesteps Billions in Global Taxes

Some of the details of Apple’s corporate tax-avoidance maneuvers according to the NYT are:

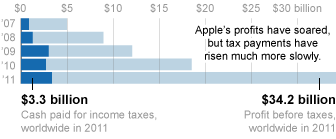

• Apple’s federal tax bill was $3.3 billion on reported profits of $34.2 billion last year, a tax rate of 9.8%;

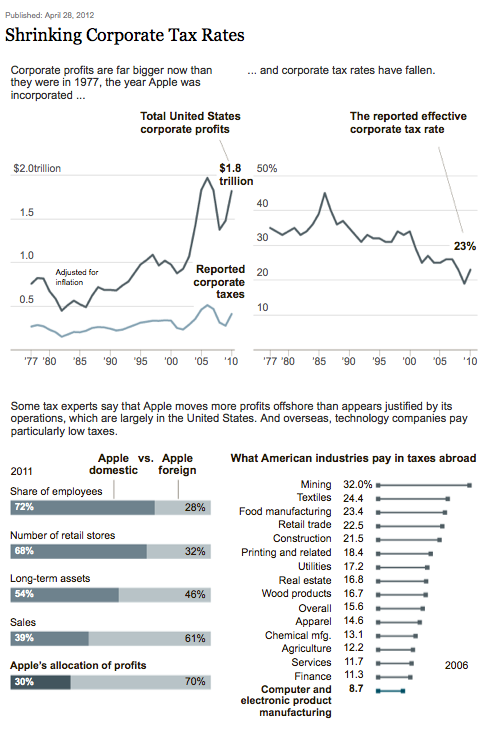

• Apple allocates 70% of its profits outside the U.S. note that the value is created in the US, but the low end manufacturing is overseas.

• A Nevada shell company let’s Apple’s U.S. business sidestep California state taxes. California corporate tax rate = 8.84%, while Nevada = 0%.

• California gives tax credits to Apple for conducting R&D in the state worht more $400 million since 1996;

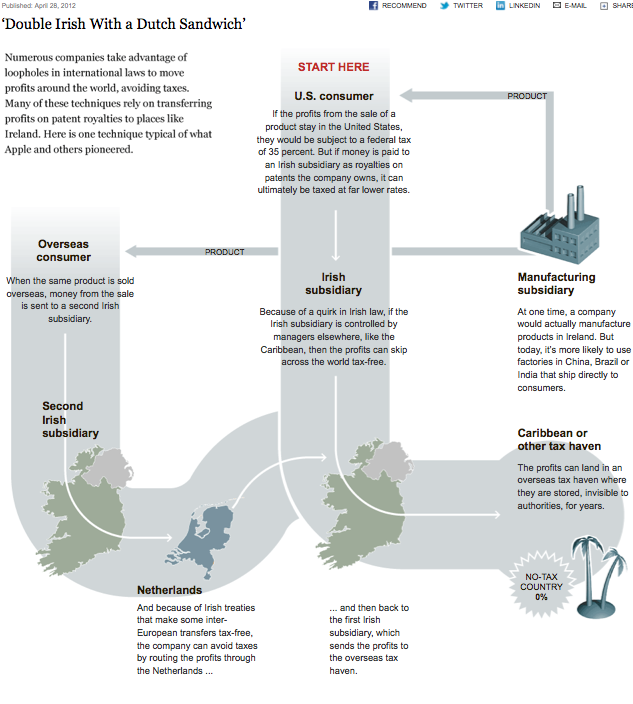

• The “Double Irish With A Dutch Sandwich” routes royalties and profits through Ireland and the Netherlands and the Caribbean. On paper, Ireland “generated” one-third of Apple’s revenue last year.

• Salespeople working in high-tax countries are employed by subsidiaries in low-tax countries.

• iTunes sales “happen” in Luxembourg –– a tax dodge with local incentives. In 2011, iTunes S.à r.l.’s revenue exceeded $1 billion

The full series is Pulitzer bait, and deservedly so.

>

Click thru for giant graphics

‘Double Irish With a Dutch Sandwich’

>

Source:

How Apple Sidesteps Billions in Taxes

CHARLES DUHIGG and DAVID KOCIENIEWSKI

NYT, April 28, 2012

http://www.nytimes.com/2012/04/29/business/apples-tax-strategy-aims-at-low-tax-states-and-nations.html

What's been said:

Discussions found on the web: