>

As we saw on Friday’s Open Thread, there is a decent amount of confusion regarding intermediate-term market direction.

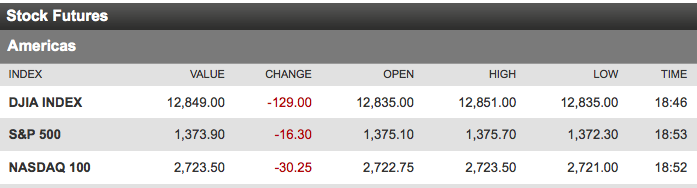

Following Friday’s punk NFP, the near term movement is down.

The key to me will be the internals, how much this accelerates or recovers before the day is over. Look for Asia to close somewhat in the Red, and its still 8 hours a day before Europe opens.

A lot can happen between now and tomorrow’s open, but it looks to be a messy one.

What's been said:

Discussions found on the web: