>

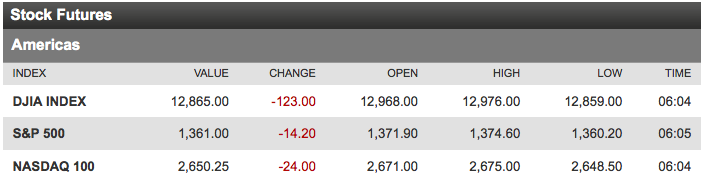

Another Monday starting the week with a triple digit Dow loss as reports show manufacturing shrank in both Europe and China (for the 6th straight month). The euro weakened, and the yields rose in France, Italy and Spain.

Asian indices fell modestly — the Shanghai Composite Index fell 0.8%; Hang Seng China Enterprises Index dropped 1.8%.

European stocks was where the pressure was after, lower by some 2% to start the week after Germany reported a terrible PMI Manufacturing number for April. The Euro-Stoxx 50 was off 2%, the FTSE 100 was off -1.48%, while the CAC 40 dropped -1.74%. The biggest losers were the DAX sown -2.43%, IBEX 35m whacked -2.79%, and the OMX Stockholm 30, down more than -3%.

Note that French President Nicolas Sarkozy became the first incumbent since 1958 not to win the first round of the nation’s election.

The Wal-Mart scandal is getting front page treatment on US financial channels, but that is not what is driving this market lower. Perhaps this is a teachable moment for those of you who haven’t figured out the difference between actual financial journalism and news flavored entertainment. This is the equivalent of “If it bleeds it leads” even thought the impact for investor is de minimis.

My contribution to Twitter is that hashtag: #newsflavoredentertainment . . .

~~~

UPDATE: April 23, 2012 9:29am

To answer a reader’s query, the pattern on these days has been down hard at the market open, rally that fails, drift, then a move higher after Europe closes.

Past performance is no guarantee of future behavior. YMMV

What's been said:

Discussions found on the web: