I have to admit to being stymied by this:

“The Securities and Exchange Commission voted Thursday in favor of bringing an administrative action against Egan-Jones, the firm said. In what would be an unprecedented move, the SEC could seek to punish the firm by stripping it of its ability to issue officially recognized ratings on securities tied to government debt and asset-backed deals. An SEC spokesman declined to comment.

The move stems from alleged “material misstatements” Egan-Jones made when it applied to regulators in 2008 to rate bonds issued by countries, U.S. states and local governments, and asset-backed securities, according to documents reviewed by The Wall Street Journal and people familiar with the matter.” (WSJ)

Here we have an allegation of a specific error, made in good faith by Egan Jones, over the course of doing business.

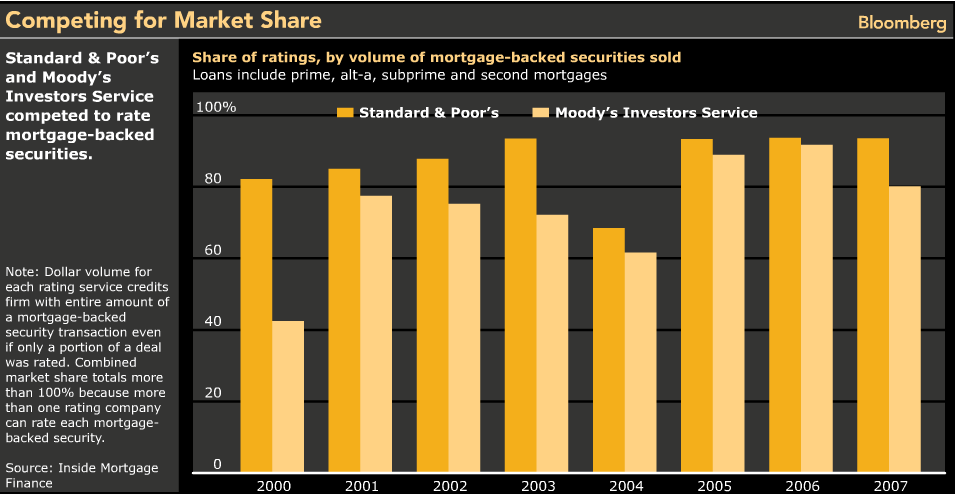

At the same time, we have a broad set of systemic errors made by the two much larger competitors, Moody’s and Standard & Poors. These two firms, by design, gave triple AAA ratings to piles of junk paper. They did so because that was what they were paid to do by the underwriters.

These were not good faith errors. They were instead a reflection of a wholly corrupted industry, designed to mislead investors and legitimize junk paper. Consider what Nobel prize winning economist Joseph Stiglitz observed:

“I view the ratings agencies as one of the key culprits. They were the party that performed that alchemy that converted the securities from F-rated to A-rated. The banks could not have done what they did without the complicity of the ratings agencies.” (Bloomberg)

Somehow, these two whales of corruption get a pass. I don’t get it . . .

>

Ratings Let Loose Subprime Scourge

Source: Bloomberg

>

Source:

Ratings Firm Is in SEC Sights

JEAN EAGLESHAM And JEANNETTE NEUMANN

WSJ, April 19, 2012, 7:38 p.m.

http://online.wsj.com/article/SB10001424052702303513404577354023825841812.html

Previously:

Ratings Agencies: Moodys, S&P, and Fitch (ORIGINAL) (February 10th, 2009)

How Can Securitization Lending Be Made Safer ? (February 6th, 2010)

Assessing Blame (January 26th, 2011)

What's been said:

Discussions found on the web: