Bloomberg.com – Steinhardt Says Bonds ‘No Place to Be,’ Favors Dividend Stocks

Investors should avoid bonds and buy stocks in companies paying high dividends, and the Federal Reserve should reconsider its low-interest-rate policy, according to Michael Steinhardt, whose hedge funds returned more than 20 percent a year for almost three decades.“Bonds are no place to be,” Steinhardt, 71, who is now chairman of New York-based WisdomTree Investments Inc., said in an interview today on Bloomberg Television’s “Money Moves” with Carol Massar. “Equities are cheap by historic standards. Equities that pay high dividends relative to bonds, relative to the stock market, I think that’s a good place to be.” Phone stocks and utilities offer the highest dividends among 10 industry groups in the Standard & Poor’s 500 Index, with yields exceeding 4.2 percent. That compared with a yield of 2.04 percent in 10-year Treasury notes and 2.02 percent for the entire S&P 500. The S&P 500 rose 12 percent during the first three months of this year for the biggest first-quarter rally since 1998 as earnings beat analysts’ estimates for a 12th straight quarter. The gauge is trading at 14.3 times reported earnings, below the average since 1954 of 16.4, according to data compiled by Bloomberg. Treasuries slipped 1.3 percent in the first quarter while corporate bonds increased 2.4 percent.

Investment News – Time to shift to stocks from bonds: Loomis Sayles’ Fuss

Legendary bond investor says investors should swap market risk for company risk

The looming threat of rising interest rates has legendary bond investor Dan Fuss thinking it’s a good time to move away from fixed income and into stocks. “We’re in the foothills of a gradual rise in interest rates,” said Mr. Fuss, vice chairman of Loomis Sayles & Co. LP and manager of the $21.2 billion Loomis Sayles Bond Fund (LSBRX). “Once they start to rise, you’re probably looking at a 20- or 30-year secular trend of rising interest rates.” When interest rates go up, the value of existing bonds drops as new bonds are issued at the higher rates. The unemployment rate is going to be the main factor in when the Federal Reserve Bank starts to raise interest rates in earnest, Mr. Fuss said.

Comment

Larry Fink hates bonds. Warren Buffett hates bonds. Guggenheim Partners hates bonds. Jeremy Siegel has hated bonds since the early years of the Clinton administration (1994). Nassim Taleb thinks every human on the planet should be short bonds. Leon Cooperman wouldn’t be caught dead owning bonds. Above are stories showing Michael Steinhardt and Dan Fuss hating bonds.

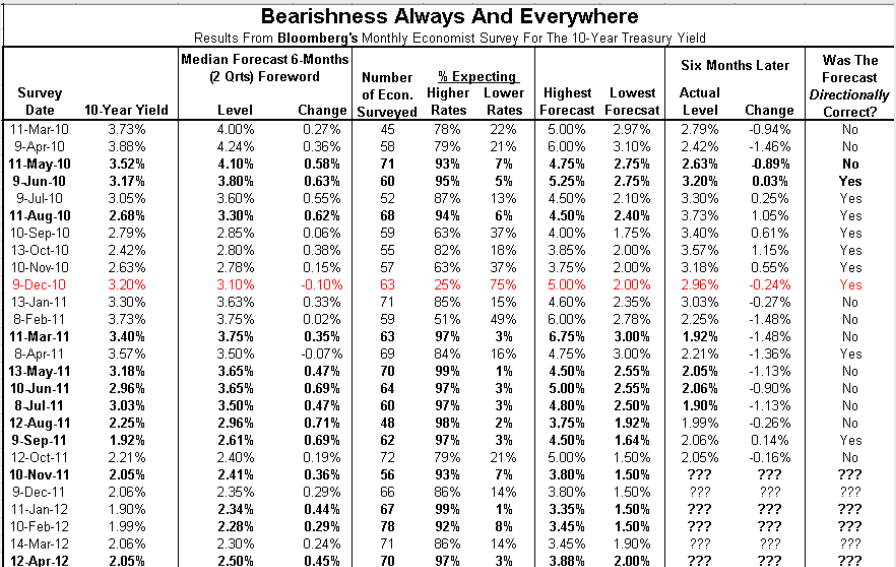

The table below shows that 90+% of economists are bearish on bonds in a typical month. The latest monthly survey (released yesterday) has 97% of economists (68 of 70) bearish on bonds.

The world is very bearish on bonds. It is hard to make a case for value in the bond market. Our only concern is this bearishness is well understood and has been priced into the market for a while now. The long bond has had a 34% total return in the last 12 months versus a 5.1% return for the S&P 500 over the same period. The bond market has also outperformed stocks over the last 30 years for the first time since the Civil War.

At some point the bond bears are going to be right. But after a decade of crying wolf, it is hard to listen to these calls.

Source: Bianco Research

What's been said:

Discussions found on the web: