Prior to law school, Hale Stewart was a bond broker with Vining Sparks, where his clients were comprised of mutual funds, insurance companies and money managers. He graduated from the South Texas School of Law in 2003. He continued his education at the Thomas Jefferson School of Law in 2007 where he obtained an LLM in domestic and international taxation, graduating Magna Cum Laude. He has three certifications from the American Academy of Financial Management: Chartered Trust and Estate Planner, Chartered Wealth Manager and Chartered Asset Manager. Mr. Stewart is also a member of the AAFM’s Board of Standards. He is the author of the book U.S. Captive Insurance Law and is currently working on his Ph.D..

~~~

“We can only win back confidence if we bring down excessive deficits and boost competitiveness,” he said. “In a such a situation, consolidation might inspire confidence and actually help the economy to grow.”

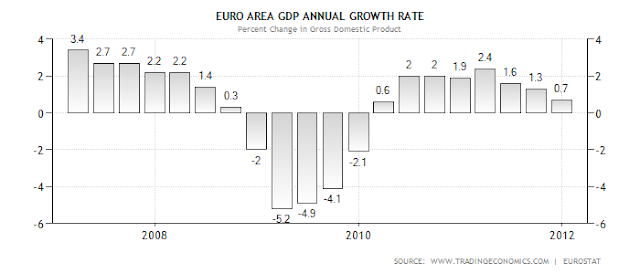

The above statement shows why austerity is simply one of the dumbest policies on the planet. First, The EU region was already growing at a slow rate when people started to talk about austerity. Consider the following chart:

Since the end of the recession, the best seasonally adjusted annual rate of growth (SAAR) is 2.4%. But that figure is really an outlier; looking at the chart we see that the rate of growth can be broken down into two time periods. The first — the five quarters coming out of the recession — growth was actually OK; it averaged 1.78% while the median number was 2%. But since then — when the continent decided to implement austerity — the growth rate slowed. Either way, growth was not strong enough for the economy to achieve “escape velocity” — a rate of growth that creates a self-sustaining, private sector led growth rate over 2.5%. As a result, unemployment hasn’t dropped, but instead has risen:

Coming out of the recession, we see increased unemployment — which is to be expected, as unemployment is a lagging indicator. However, since then unemployment hasn’t dropped, indicating that the economy hasn’t hit that critical growth level where employment picks up. In fact, we see unemployment increase overall,

INDICATING THAT AUSTERITY IS FAILING.

So — what was the policy response? Cut spending in the hopes that would “inspire confidence” so that the economy would grow. The problem with this is simple. It completely runs counter to what is needed — spending. Again, consider the GDP equation

C+I+X+G=GDP

Consumer spending and investment drop in a recession and in the quarters coming out of a recession. Exports help, but they’re not the predominant component of GDP. That leaves government spending to pick-up the slack. And there is plenty of room to do this. Consider the following chart of the EU debt/GDP level:

It currently stands at 85% — hardly crisis levels.

And we haven’t even mentioned the worst part yet: the overall economy is now probably in a second recession, largely caused by slowing demand, caused by (drum roll please) austerity! And, worst of all, the economy may be entering a negative feedback loop: low demand leads to more unemployment which leads to lower demand … you get the idea.

As for the whole “confidence will return” argument: businesses don’t invest in slow-growth environments when there is obviously slack demand. Put another way, ask yourself this question: would you rather sell your product into a market that has 2% SAAR or 3.5% SAAR?

Also consider this from the NY Times:

With political allies weakened or ousted, Chancellor Angela Merkel’s seat at the head of the European table has become much less comfortable, as a reckoning with Germany’s insistence on lock-step austerity appears to have begun.

“The formula is not working, and everyone is now talking about whether austerity is the only solution,” said Jordi Vaquer i Fanés, a political scientist and director of the Barcelona Center for International Affairs in Spain. “Does this mean that Merkel has lost completely? No. But it does mean that the very nature of the debate about the euro-zone crisis is changing.”A German-inspired austerity regimen agreed to just last month as the long-term solution to Europe’s sovereign debt crisis has come under increasing strain from the growing pressures of slowing economies, gyrating financial markets and a series of electoral setbacks.Spain officially slipped back into recession for the second time in three years on Monday, after following the German remedy of deep retrenchment in public outlays, joining Italy, Belgium, the Netherlands and the Czech Republic. In the Netherlands, Prime Minister Mark Rutte handed his resignation to Queen Beatrix on Monday after his government failed to pass new austerity measures over the weekend.The political upheaval drove stock markets on the Continent sharply lower, with Germany’s DAX index finishing the day down 3.4 percent. The sell-off in Europe dragged American indexes down around 1 percent. A survey of European purchasing managers showed an unexpected plunge in confidence this month.The Netherlands, a staunch supporter of the German position, became the latest European country forced into early elections by the European crisis, just one day after the first round of presidential voting in France raised the possibility that the incumbent, Nicolas Sarkozy, would be unseated by his Socialist challenger, François Hollande, in a runoff election.From trading floors to polling stations to the streets of cities across Europe, the message appears increasingly to be that countries cannot cut their way to fiscal health. They need growth, too. In recent months, powerful voices have joined the chorus, including those of the managing director of the International Monetary Fund, Christine Lagarde, and Italy’s prime minister, Mario Monti. Treasury Secretary Timothy F. Geithner has called repeatedly for Europe to defer budget cutting in favor of some form of stimulus spending

OK, so people have put their hand on the stove, turned the heat on an learned that its hot. Wow — hardly a new concept to people who read this blog, but obviously to people who haven’t learned a damn thing from history. Anyway, it’s good to see sentiment changing, but we’re still not out of the woods.

See also this post at Brad DeLong, which links to Professor Krugman.

PART II AFTER THE JUMP

UK In Technical Recession; Or, No REALLY, Austerity is an Incredibly Stupid Idea

It’s another successful austerity program!

From the April 4-5 meeting minutes of the Bank of England:

According to the third ONS estimate, GDP had fallen by 0.3% in the fourth quarter of 2011, 0.1 percentage points weaker than reported in the second release. The ONS had also revised down the path for household consumption during 2011 such that the level at the end of the year was 0.5% lower than previously estimated. Together with an upward revision to households’ income, this implied a sizable revision upwards to the estimated household saving rate. This now appeared to have fallen back only modestly since its peak in 2009.

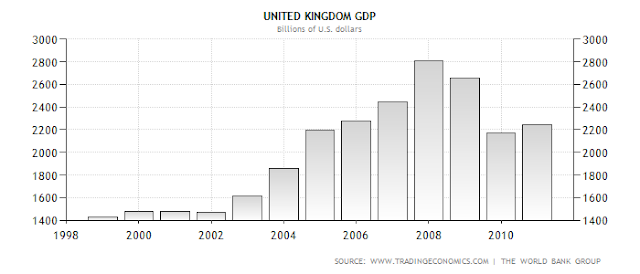

The top chart shows total GDP, which is still below pre-recession levels. Also note there were two years of decline (2009 and 2010) with a slight increase in 2011. The second chart shows the quarter to quarter growth, which shows that in three of the last give quarters UK GDP has shrunk.

The good news in the above statement is the increased savings rate which means two things going forward:

1.) Consumers have increased spending power if they choose to use it, and

2.) The deposit base is increasing, which increases bank reserves. This can lead to an increase in overall credit, assuming there is an increase in demand.

In line with the usual pre-release arrangements, the Governor informed the Committee that manufacturing output had fallen by 1% in February and that output in January had been revised down. This was somewhat at odds with the more positive message from the corresponding business surveys. The data on service sector output in January were consistent with solid growth in services in the first quarter of 2012. The CIPS/Markit indices for manufacturing, services and construction had all risen in March and the composite expectations balance had reached its highest level in over a year. The BCC Quarterly Economic Survey had recorded rising sales balances for both manufacturing and services in the first quarter. And the Bank’s Agents had reported a broad-based, if still modest, pickup in output growth over the previous three months. Consistent with these reports, household and corporate broad money growth had increased in January and February on a three-month annualised basis.

The above chart shows the YOY percentage change in UK Industrial production, which has been negative for the few months. The divergence between the Markit survey and IP numbers can be explained by looking at the internals of the Markit report:

In short, UK manufacturing increased because it filled old orders and replenished inventories. In addition, the UK’s primary market — the EU — is slowing down. The Market economists comments highlight the basic conclusion to draw: manufacturing won’t be a drag, but nor will it be a strong contributor to the economy in the first quarter.

For the second month in a row, the ONS had reported a particularly large contraction in construction output, which it estimated to have fallen by around 12% in each of December and January on a non-seasonally adjusted basis. Even if activity were to rise strongly in February and March, measured construction output was likely to show a very sharp fall in the first quarter as a whole. This was at odds with other indicators of construction activity from CIPS/Markit, Experian and the Bank’s Agents, which had generally pointed to much smaller declines around the turn of the year. Although construction orders had been weak, the Construction Products Association was expecting only a modest reduction in output during the year as a whole.

Here are the relevant data points from Markit:

Only time will tell who is right. However, an increase in construction spending would be most welcome as this has an ancillary economic effect down the line.

In the absence of revisions to the latest vintage of data, the contraction in measured construction output was likely to depress measured GDP growth significantly in the first quarter. Indeed, it was possible that the ONS’s preliminary estimate for GDP could record a fall in aggregate output. In the second quarter, some activity was likely to be lost because of the extra bank holiday associated with the Queen’s Diamond Jubilee celebrations. With output having already contracted in the fourth quarter of last year, the Committee could not rule out the publication of official data showing GDP falling for three successive quarters. Nevertheless, the Committee’s judgement was that, abstracting from both the puzzling weakness in measured construction output and the impact of one-off factors, the economy appeared likely to be expanding, albeit only modestly, in the first half of the year

And now, just to add the icing on the cake, we learn that the UK is in a technical recession (from the office of national statistics)

- The chained volume measure of GDP decreased by 0.2 per cent in Q1 2012

- Output of the production industries decreased by 0.4 per cent in Q1 2012, following a decrease of 1.3 per cent in the previous quarter

- Construction sector output decreased by 3.0 per cent in Q1 2012, following a decrease of 0.2 per cent in the previous quarter

- Output of the service industries increased by 0.1 per cent in Q1 2012, following a decrease of 0.1 per cent in the previous quarter

- GDP in volume terms is flat in Q1 2012, when compared with Q1 2011

Britain’s economy has fallen into its second recession since the financial crisis after an shock contraction at the start of 2012, heaping pressure on Prime Minister David Cameron’s government as it reels from a series of political missteps.

Britain’s Conservative-Liberal Democrat coalition has seen its support crumble after weeks of criticism over unpopular tax measures in last month’s budget, and is under further pressure from revelations about its close links with media tycoon Rupert Murdoch.

With local elections taking place on May 3, there could hardly be worse timing for Wednesday’s news from the Office for National Statistics that Britain’s gross domestic product fell 0.2 percent in the first quarter of 2012 on top of a 0.3 percent decline at the end of 2011.

Most economists had expected Britain’s economy to eke out modest growth in early 2012, but these forecasts were upset by the biggest fall in construction output in three years, coupled with a slump in financial services and oil and gas extraction.

For a good summation of the report and what this means, here is a link to the FT Money Supply Blog

What's been said:

Discussions found on the web: