Among the exercises I occasionally undertake is to dig into the history books and see, in retrospect, how things have played out relative to what the punditocracy had proclaimed (works with punditry on politics, markets, economics, sports, etc.) . With Barron’s releasing its semi-annual “big money” survey, there’s really no better opportunity to page back through history. As we went through the worst economic near-collapse in generations, I always find it most instructive to start my analysis in the summer/fall of 2007 and take it from there. (I will never, ever forget attending a very small dinner on the evening of October 2, 2007 (at Casa Lever, then Lever House), at which David Rosenberg was the speaker. He laid out his assessment of what was happening – and what was going to happen – in the economy, and the group of 12 or so (most unfamiliar with his work or world view) looked at him as if he were a Klingon. Total disbelief. The S&P500 peaked one week later to the day – October 9, 2007.)

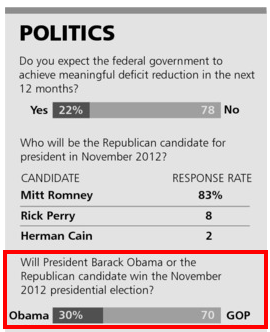

The current big money poll (Reason To Cheer), brings us this (S&P500 = ~1380):

America’s portfolio managers see more gains for stocks in our latest Big Money poll. They are wary of bonds, hopeful about the economy and predict that President Obama will be re-elected.

On that note, let’s have a look at where the Barron’s big money participants stood in early November 2007 (S&P500 = ~1520):

Although U.S. money managers are less optimistic than in the spring, bulls still outnumber bears by more than 2-to-1. Some even say the Dow will top 16,000 by mid-2008. Insights into bonds, politics, the Fed and more.

Can you see where this is going? We were on the cusp of the worst recession in 70+ years and a market that would lose 50+ percent peak-to-trough. The writing was on the wall in a huge, bold font.

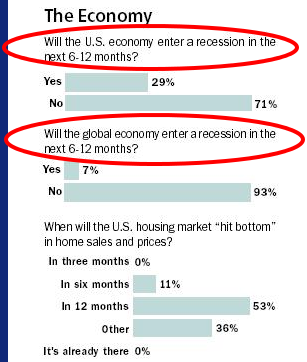

That article contained this graphic:

Suffice to say that following the Barron’s big money poll in November 2007 was a money-loser.

Fast forward to April 2008 (S&P500 = ~1400)

The professional investors surveyed in our latest Big Money Poll are getting set to jump back into stocks. What they like, and why.

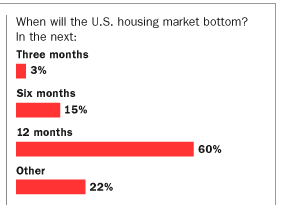

That poll contained this graphic:

Moving on to November 2008, the Barron’s big money poll was titled A Sunnier Season, and teased with this (S&P500 = ~970):

Barron’s latest Big Money poll reveals unrelenting bullishness among many money managers, despite their pronostications [sic] for a “contagious” recession and punk profits through 2009.

The article contained this gem: “The managers also cast their votes for BlackBerry maker Research in Motion (RIMM), whose shares have been decimated this year…” RIMM was mid-50s at the time.

In April 2009, when it was, literally, time to margin your account to the hilt and throw it all into equities, the Barron’s big money participants were cautious (S&P500 = ~855):

The pros in our latest Big Money poll say they’re bullish or very bullish about the stock market. But they have good reason not to jump in with both feet yet.

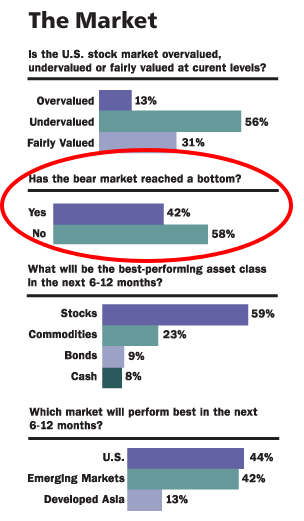

They were, of course, wary at exactly the wrong time:

For one, just 56% of today’s poll participants think the stock market is undervalued, down from 62% last fall. Thirteen percent say stocks are overvalued, up from a prior 7%. And an alarming 58% say the market hasn’t bottomed yet, even though the Dow Jones industrials hit a low of 6469 in March, before recovering to a recent 8100.

The bear market had clearly taken its toll on the psyche of the managers who participated:

In November 2009, Barron’s titled its big money poll Treading Carefully, and teased with this (S&P500 = ~1050):

The bull is still in charge, say America’s money managers in our latest Big Money Poll. But it pays to be cautious, as bargains are getting harder to find. The case for Microsoft.

April 2010 brought Be Very Careful (S&P500 = ~1190):

The bulls in our Big Money poll pulled in their horns a bit and see only tepid gains for stocks between now and year’s end. Stay away from bonds.

The S&P500 closed the year at 1257, up an admittedly “tepid” 5.6% on a price-only basis. The 10-year US Treasury went from about 3.80 to end the year at about 3.31 after hitting about 2.40 in October and then selling off – there was no reason to “stay away” from them.

November 201o brought us Bears, Beware! (S&P500 = ~1190)

America’s money managers say stocks are cheap and the economy will keep growing. Why they’re bullish on tech, bearish on Congress.

The November 2010 poll showed continued caution regarding the bond market, and offered up another majority opinion about a “bond bubble” which has yet to materialize (count me among those who’s not been in the bubble camp):

On we go to April 2011, in which the big money poll was titled Watch Your Step (S&P500 = ~1340):

America’s money managers are bullish in Barron’s latest Big Money poll, but picking their spots with care. The crowd is seeking safety in big, defensive stocks.

That poll inquired about the prospect of a Fed rate hike:

What’s hilarious is that the floor the poll presented on the 10-year seems to be 3 percent, as there’s no lower option. Oops!

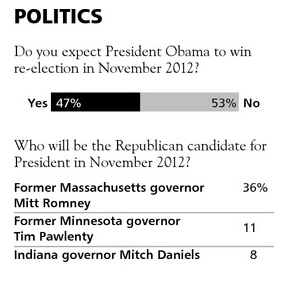

It also asked a political question:

The Big Money managers don’t think Donald Trump has any chance of becoming the Republican presidential candidate in 2012 [Ed Note: Like we needed guidance on that?], although 36% expect former Massachusetts Governor Mitt Romney to head the ticket. Our respondents aren’t as confident as they were six months ago, however, that the GOP will wallop the incumbent, President Obama. In our newest poll, 47% of managers indicate the president will win another term, up from 29% who thought so last fall.

Finally, November 2011 brought us Cautious, but Bullish (S&P500 = ~1220):

Our Big Money Poll found surprising confidence [Ed. note: At this point, seriously, why should we be “surprised” at the confidence?] among market pros, especially given that it went out near the market bottom.

From my perspective as a Democrat, I can only hope the “big money’s” forecasting prowess is as good on politics as it is on the economy and markets:

Remarkably, I noted that at least one manager who was pretty much dead wrong in 2007 continues to hold sway in 2012, except that he’s apparently working for another shop. Not gonna get into the details, but the ongoing question of what it takes to lose one’s microphone continues to gnaw at me.

It’s all about Bob Farrell’s Rule #9: When all the experts and forecasts agree – something else is going to happen.

As always, Caveat Emptor.

November 2007 and April 2008:

November 2008 and April 2009:

November 2009 and April 2010:

November 2010 and April 2011:

November 2011 and current:

Invictus out.

@TBPInvictus

What's been said:

Discussions found on the web: