>

Since tomorrow is the big NFP day, let’s take a look at some of the details of recent job creation, via today’s Bloomberg Briefing:

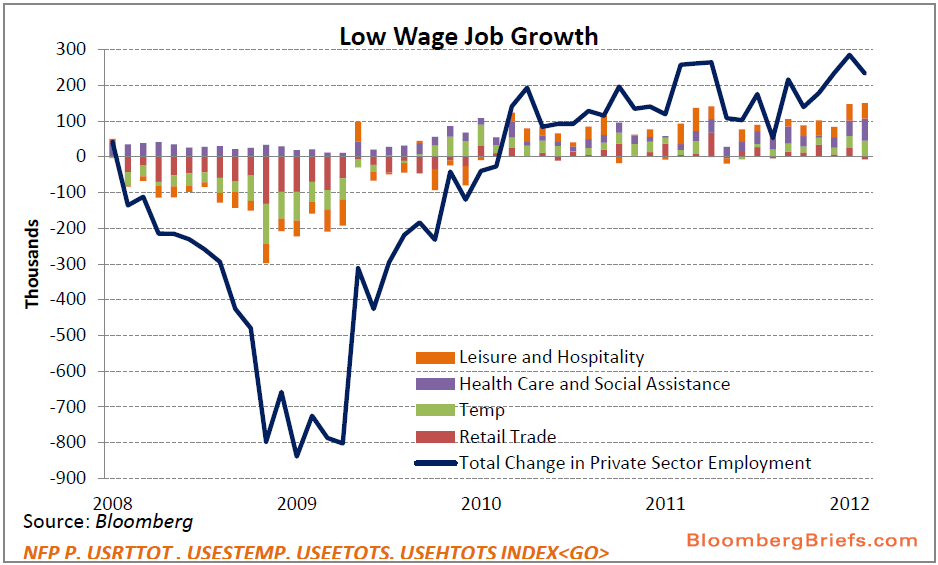

“Improved hiring conditions and a decline in jobless claims are encouraging signs the economy is slowly healing. While these gains in the labor market may be sustainable over time, the quality of jobs driving this improvement is weak and confined to low-paying areas of the economy. This indicates that growth will remain somewhat weak throughout 2012. It also partially explains the lower rate of productivity gains observed over the past year . . .

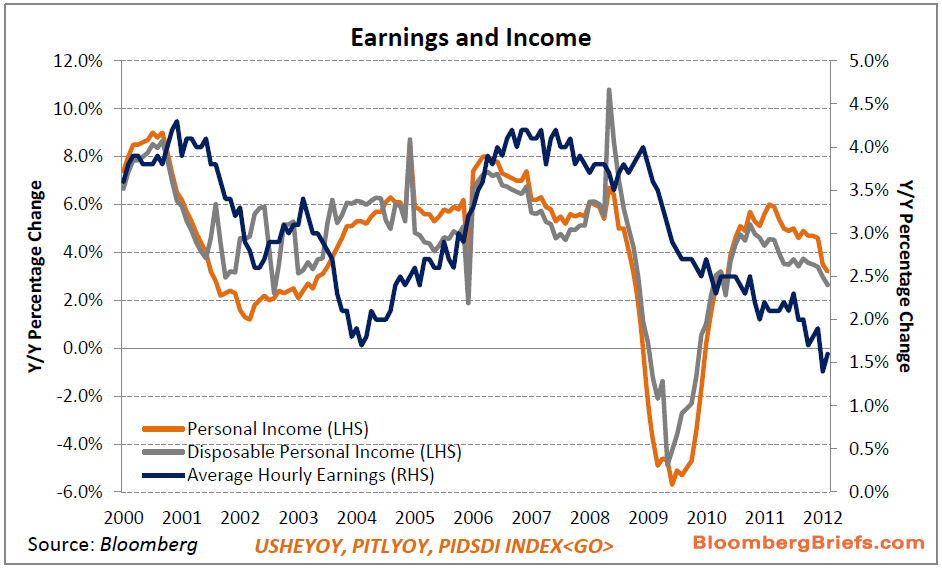

Even with the encouraging increase in hiring over the past six months, weak income gains and sluggish wage growth have been persistent features of the current economic expansion. The pace of income gains is well below that of the past two jobless recoveries and real average hourly earnings continue to decline.The strength of labor employment gains in the subsectors of leisure and hospitality, health care and social assistance, retail trade and temporary jobs, indicate a growing low-wage bias in the economy. This is due in part to excess labor market slack and indicative of broader structural issues in the labor market. Overall household spending remains historically weak and as the price of gasoline increases above $4 per gallon in coming days these factors taken together pose a risk to second quarter growth.

While roughly 41 percent of the jobs created since 2010 are in the aforementioned low-wage sectors, they only account for 29 percent of the total labor force. Factoring in public sector job losses, these four low-wage-paying subsectors account for a whopping 70 percent of all gains during the past six months.

These sectors only accounted for roughly 25 percent of the job losses during the recession, well below the gains during the recovery and significantly below those observed over the past six months. This points to a significant underutilization of labor resources in the current expansion and is one reason why Fed policy makers signaled they intend to remain accommodative over the next two years . . .”

Here is why:

“The ability to turn to cheap and productive labor outside the U.S., as well as the advanced skills demanded by many industries, has diminished the employment horizons for many workers. The unemployment rate among workers with two or more years of college – the cohort most likely to be caught in the squeeze between demand for advanced skilled labor and the outsourcing of many professional office and back office jobs – while declining to 7.3 percent in February from 8.9 percent in September 2010, is still well above the 3.3 percent pre-recession low observed in November 2007.

Interesting stuff

>

Source:

Labor Market Gains Increasingly Driven by Low-Wage Jobs

Joseph Brusuelas

Bloomberg BRIEF, April 5, 2012 www.bloombergbriefs.com

What's been said:

Discussions found on the web: