Matt Trivisonno looks at real time payroll withholding taxes on a year over year basis. He calls it the “greatest economic indicator of all time.”

Hyperbole aside, it is a pretty interesting data series. Here are Matt’s comments from last week:

“Viewing the job market through the withholding-tax data, we see steady year-over-year growth continuing from February to March.>

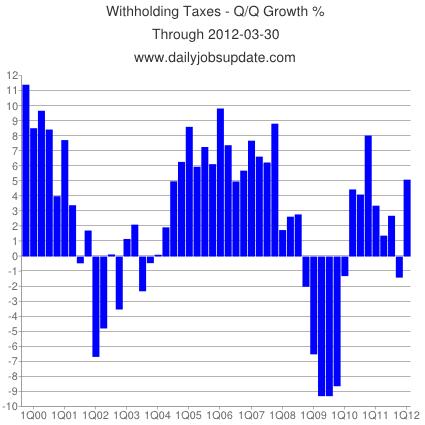

First quarter withholding-tax collections came in strong with a 5% annual growth rate. (2011 looks weak on this chart because of the tax cut.):

>

~~~

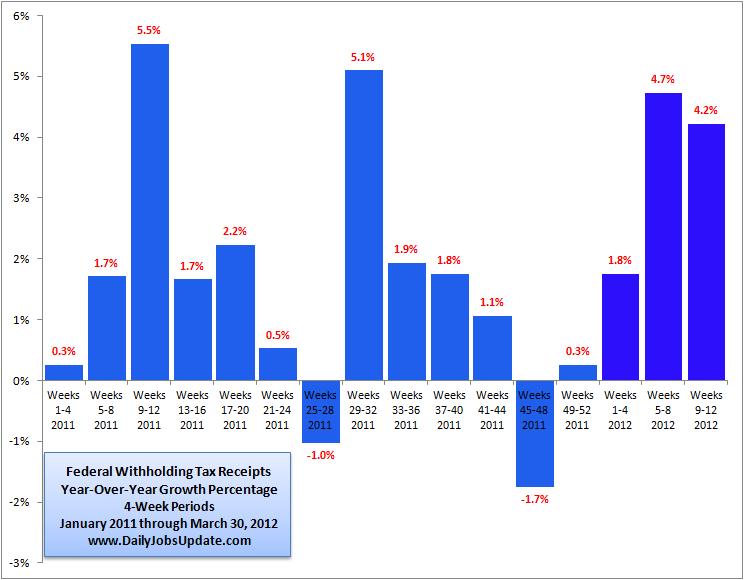

Calendar March was up only 2.64%, however there was one less business day in the month this year. Using a daily average instead, calendar March was up 7.30%. However, the calendar is a little askew because of leap year, so 7.30% is likely over-optimistic. If instead, we look at the data in 4-week time-periods, we see that the annual growth rate was 4.2% for weeks 9-12:

>

>

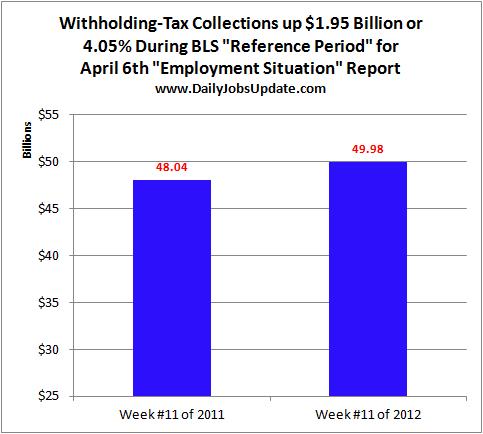

Friday’s “Employment Situation” report (a.k.a. “Non-Farm Payrolls”) is derived from surveys done during the “reference period”. That’s the week which contains the 12th of the month. For the March report coming out on April 6th, that’s week #11 of 2012. Comparing to week #11 from last year, we see a 4.05% growth rate:

Source:

Withholding-Tax Collections Continued Strong in March

Daily Jobs Update, by Matt Trivisonno

What's been said:

Discussions found on the web: