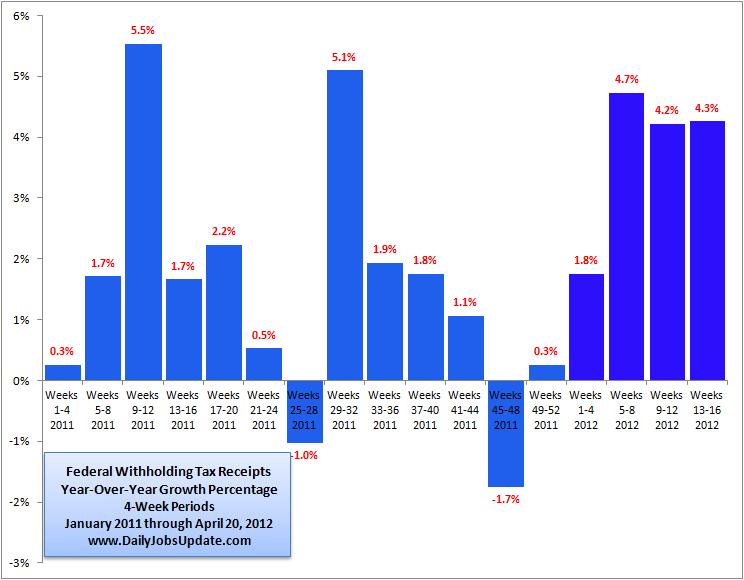

First quarter withholding-tax collections came in strong with a 5% annual growth (Note: 2011 looks weak on this chart because of the tax cut).

>

>

Over the last 4 weeks, the annual growth rate of federal withholding-tax collections has ticked up from 4.2% to 4.3%.”

Viewing the job market through the withholding-tax data, we see steady year-over-year growth continuing from February to March. Friday’s jobs report may or may not meet expectations of +201,000 jobs, but odds of the report containing a nasty surprise look small.

Source:

Daily Jobs Update

by Matt Trivisonno

Over the last 4 weeks, the annual growth rate of federal withholding-tax collections has ticked up from 4.2% to 4.3%.”

What's been said:

Discussions found on the web: