My afternoon reading:

• Hedge or Bet? Parsing a Trade (WSJ)

• Q&A on Facebook’s IPO: What does it mean for you? (Washington Post)

• Is Dimon’s ‘Stupid’ Defense a Smart Move? (Yahoo Finance) see also Polishing the Dimon Principle (WSJ)

• Accidentally Released – and Incredibly Embarrassing – Documents Show How Goldman et al Engaged in ‘Naked Short Selling’ (Rolling Stone)

• Assessing the Representativeness of Public Opinion Surveys (People Press)

• Ronald Reagan on Marriage: Love, Dad (Letters Of Note)

• Let The Honeymoon Begin: Romney’s Poll Numbers Perk Up (TPM)

• The hard part of solution journalism is agreeing on the problems (Jonathan Stray)

• Is Death Bad for You? (The Chronicle)

• Five Lessons From Music’s Most Feared Manager, Led Zeppelin’s Peter Grant (Businessweek)

What are you reading?

>

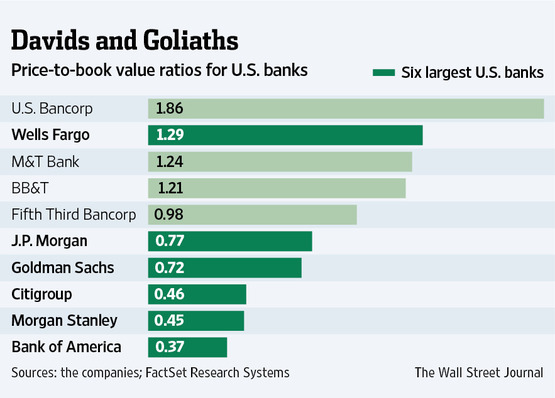

Bank Investors Bail on Too-Big-to-Fail

Source: WSJ

What's been said:

Discussions found on the web: