My afternoon reading:

• Lehman E-Mails Show Wall Street Arrogance Led to the Fall (Bloomberg)

• Study Says Broker Rebates Cost Investors Billions (NYT)

• Traders Being Accountable to Themselves (Trader Planet)

• Zuckerberg: The Maturation of the Billionaire Boy-Man (NY Mag)

• Customer Divide at MF Global (WSJ)

• Enter The Pivot: The Critical Course Corrections Of Flickr, Fab.com, And More (Fast Company)

• Facebook at 99 Times Profit Exceeds 99% of S&P 500 Index (Bloomberg) see also Reasons to Buy Facebook, After Hype Fades (WSJ)

• How to Live Unhappily Ever After (WSJ)

• Singularity University: meet the people who are building our future (Guardian)

• What I’ve Learned About Learning (Zen Habits)

Whats on your tablet?

>

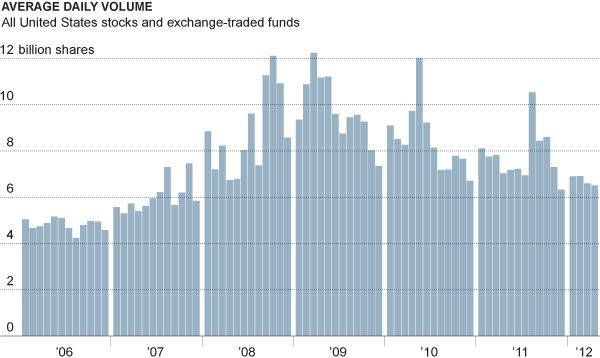

Stock Trading Volume Has Declined

Source: NYT

What's been said:

Discussions found on the web: